Chương 3 Market Focus 24th April 2023

Market Focus: Investors Eagerly Await Highly Anticipated Economic Reports

What happened in the market last week?

• Canadian Consumer Price Index (CPI) fell, affirming the Bank of Canada's decision to keep rates unchanged.

• Bank of Canada Governor Macklem stated that annual CPI inflation was down to 4.3% in March and further declines are expected, causing the Canadian Dollar to weaken.

• Multiple manufacturing and services PMI data were released for Europe, UK, and US at the end of the week.

• US manufacturing and services PMI came in above expectations, showing growth.

• The UK and Europe had mixed data, with a decline in manufacturing but an increase in services.

• JPY weakened significantly against its counterparts, improving the risk mood in the market.

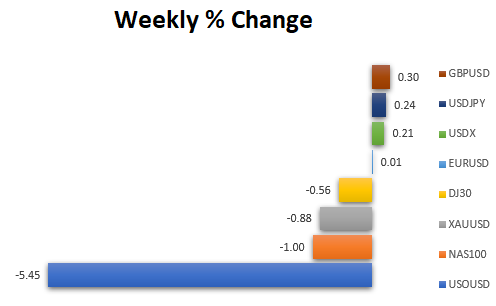

Last Week’s Market Pair Changes

Despite predictions of rate cuts and slowing economic growth, the US dollar (DXY) has remained stable. However, the dollar has weakened against major currencies due to the slowing growth of the US economy. The Federal Reserve may pause tightening in June after an interest rate hike next month. Despite the economic slowdown, rate differentials are still supporting the dollar. The USDX was stable, but rise by 0.21 %.

• XAUUSD (Gold) fell by 0.88%.

• Major US stocks fell for the week, with DJ30 lowered by 0.56 % and NAS100 decreased by 1.00 %.

• EURUSD was rather flat, rising by only 0.01 %, while GBPUSD and USDJPY were higher by 0.30 and 0.24 respectively.

• USOUSD (oil) was set for weekly loss as economic uncertainty weighs in, with USOUSD falling by 5.45 %.

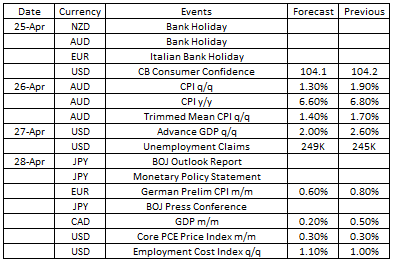

What to focus on this week?

This week, market participants anticipate several critical economic reports, including the BOJ Rate Statement, US Advance GDP, and Core PCE Price Index. These key reports will provide valuable insights and help investors and traders make informed decisions. Don't miss out on this opportunity to stay ahead of the curve.

Here are the key events to watch out for:

Consumer Price Index | Australia (April 26)

The annual inflation rate in Australia rose to 7.8% in Q4 2022 from 7.3% in Q3 2022.

For Q1 2023, analysts expect a more moderate increase of 6.8%.

Advance GDP | US (April 27)

The US economy expanded at an annualised rate of 2.6% in Q4 2022.

For Q1 2023, analysts predict a rate of 2.3%.

BOJ Rate Statement | Japan (April 28)

During its March meeting, the Bank of Japan unanimously voted to keep its key short-term interest rate at -0.1% and the rate for 10-year bond yields at around 0%.

This month, analysts expect that the rate will stay the same as the board introduces new quarterly growth and price estimates in Kazuo Ueda's first policy meeting.

Prelim Consumer Price Index | Germany (April 28)

Germany's consumer price inflation reached a seven-month low in March 2023, recording a year-on-year rate of 7.4%, down from 8.7% in the previous two months. The figure remained well above the European Central Bank's target of 2%.

Analysts predict a further decrease in April 2023, with an expected rate of 7.0%.

Gross Domestic Product | Canada (April 28)

Canada's economy jumped 0.5% in January 2023, following a slight contraction of 0.1% in December 2022.

For February, analysts expect it to increase by 0.3%.

Core PCE Price Index | US (April 28)

Core PCE prices in the US, which exclude food and energy, rose by 0.3% month-on-month in February 2023, following a downward revision of 0.5% in the previous month.

For March 2023, analysts expect a 0.4% increase.

Employment Cost Index | US (April 28)

Compensation costs for civilian workers in the US rose 1% in Q4 2022, a third straight slowdown, compared to a 1.2% increase in the previous quarter.

For Q1 2023, analysts expect the index to rise by 0.8%.