Chương 3 What is Margin Call and Stop Out Level?

1. Margin Call Level

A margin call is what happens when a trader no longer has any usable/free margin. In other words, the account needs more funding. This tends to happen when trading losses reduce the usable margin below an acceptable level determined by the broker.

Margin call is more likely to occur when traders commit a large portion of equity to used margin, leaving very little room to absorb losses. From the broker’s point of view this is a necessary mechanism to manage and reduce their risk effectively.

Below are the top causes for margin calls, presented in no specific order:

·Holding on to a losing trade too long which depletes usable margin;

·Over-leveraging your account combined with the first reason;

·An underfunded account which will force you to over trade with too little usable margin;

·Trading without stops when price moves aggressively in the opposite direction.

Results of Margin Call

When a margin call takes place, a trader is liquidated or closed out of their trades. The purpose is two-fold: the trader no longer has the money in their account to hold the losing positions and the broker is now on the line for their losses, which is equally bad for the broker. It is important to know that leverage trading brings with it, in certain scenarios, the possibility that a trader may owe the broker more than what has been deposited.

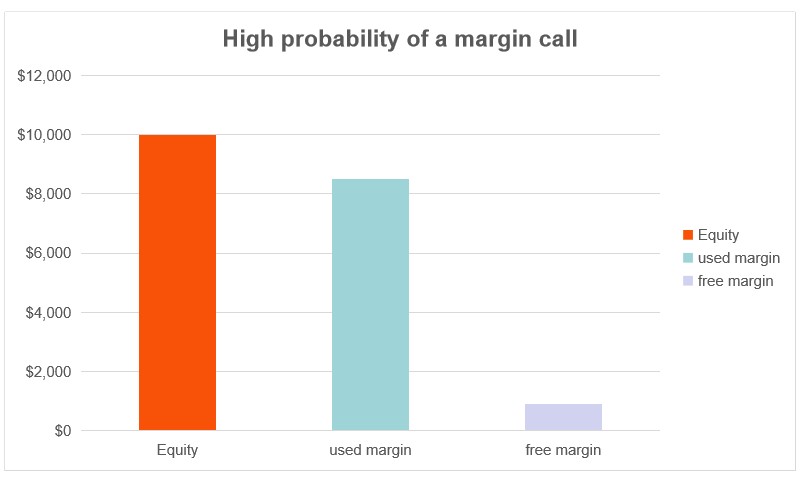

Below is a visual representation of a trading account that runs a high chance of receiving a margin call:

Deposit: $10 000

Number of standard (100k lots traded): 4

Margin percentage: 2%

*Used margin: $9 000

Free margin: $1 000

For simplicity, this is the only position open and it accounts for the entire used margin. It is clear to see that the margin required to maintain the open position uses up the majority of the account equity. This leaves a free margin of only $1000.

Traders may operate under the false assumption that the account is in good condition; however, the use of leverage means that the account is less able to absorb large movements against the trader. In this example, if the market moves more than 25 points (not accounting for spread) the trader will be on margin call and have the position liquidated ($40 per point x 25 points = $1000).

2. Stop Out Level

A stop out level in Forex is a specific point at which all of a trader's active positions in the foreign exchange market are closed automatically by their broker, because of a decrease in their margin levels, meaning that they can no longer support the open positions. Forex is a leveraged market, which means that for every dollar traders put up for each trade, their broker can lend them a set amount of dollars that surpasses the trader's actual capital, so they have the potential to gain more profits.

Imagine that you have a trading account with a broker that has a 50% margin call level, and a 20% stop out level.

Your balance is evaluated at $10,000, and you open one trading position with a $1,000 margin. If the loss on this position reaches $9,500, your account equity turns out to be $10,000 - $ 9,500 = $500.

This is already 50% of your used margin, so the broker will issue a margin call warning as a result of this. Thereby, when your loss on your position reaches $9,800, and your account equity appears to be $10,000 - $9,800 = $200 (i.e. 20% of the used margin), it will then simply trigger a stop out, and the broker will close your losing position to prevent all future losses.

How to Avoid or Prevent Stop Out

If you want to avoid any troublesome outcomes, you need to take some steps to prevent stop outs. Generally, it is all about appropriate trade management, however, we do have some useful tips for you to follow.

· Stop yourself from opening too many orders simultaneously;

· Use stop-losses. This will allow you to control your losses;

· Use hedging techniques.