章節 2 How to Verify Your Broker's ASIC License?

1. A Brief introduction to ASIC

The Australian Securities and Investments Commission (ASIC) is an independent Australian government body that acts as Australia's corporate regulator. ASIC' s role is to enforce and regulate company and financial services laws to protect Australian consumers, investors and creditors.

Its areas of responsibility include corporate governance, financial services, securities and derivatives, insurance, consumer protection and financial literacy.

What you should notice is that to carry on a business of providing financial services in Australia, a company must hold an Australian Financial Services Licence(AFSL), unless it is exempt or authorized to provide those services as a representative of another company that holds an AFS licence.

2. Steps to Verify a ASIC License

This simple guides will teach you how to check your broker’s ASIC license and understand what activities the broker is authorized to perform under it.

Step 1

Go to ASIC's website https://asic.gov.au/ ,and click into Professional register.

Step 2

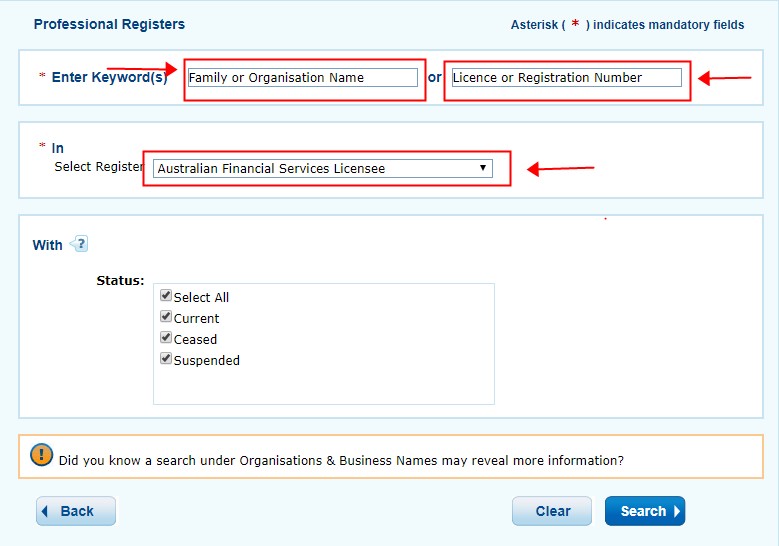

Type in the broker’s name or license number (if you know it) and select Australian Financial Services Licence to search.

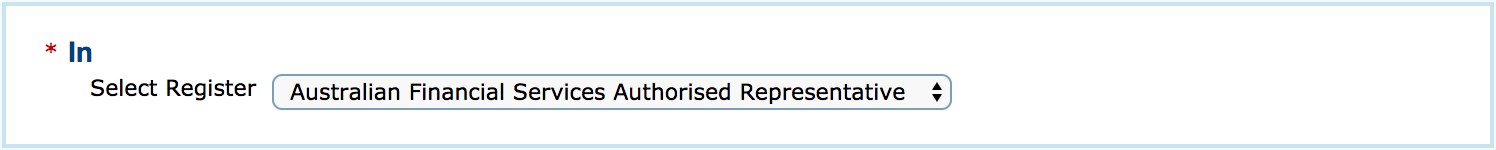

If the search comes back with no results, it might be that the firm does not have an AFSL license on its own and is assigned as authorized representative under someone else. Just in case, search the registry again by selecting from the dropdown:

Step 3

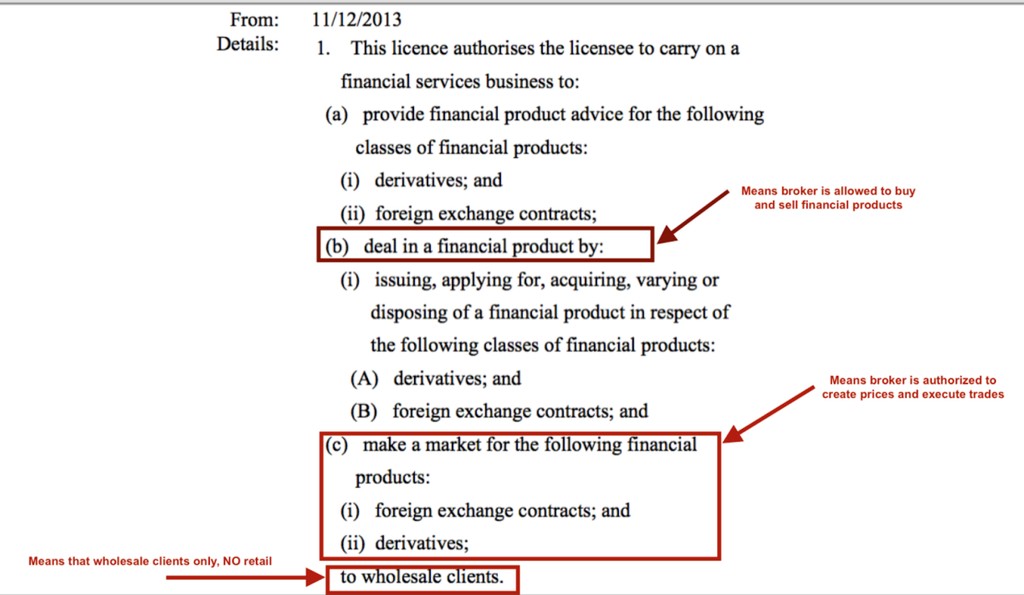

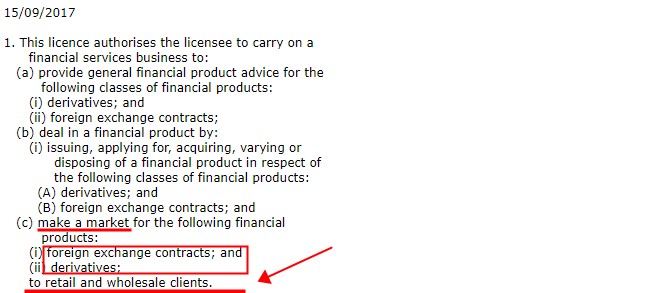

Check business registration address, service address.See if the key word “foreign exchange” appears in the License Authorization Conditions to know weather the company deal with Forex and understand the license permissions in this important section.

Condition “Make a Market in financial products” is a key one that you should be looking at. This means that license holder is allowed to quote prices for listed financial products and execute clients’ orders.Under ASIC language, market making is not market making brokerage business model, it is simply to note that licensee is allowed to conduct a brokerage activity (price and execute clients).

“Deal in financial product” permission is often confused to be the permission that allows to execute clients’ trades. But it is not the case. A license holder ‘deals’ in a financial product when they apply for or acquire a financial product or issue a financial product. It could be interpreted as: a license holder is permitted to sell and buy financial products.

It is also noted what type of clients could be serviced: retail, wholesale, or both.

Here is an example of wholesale only Forex and derivatives broker:

Here is an example of both retail and wholesale Forex and derivatives broker:

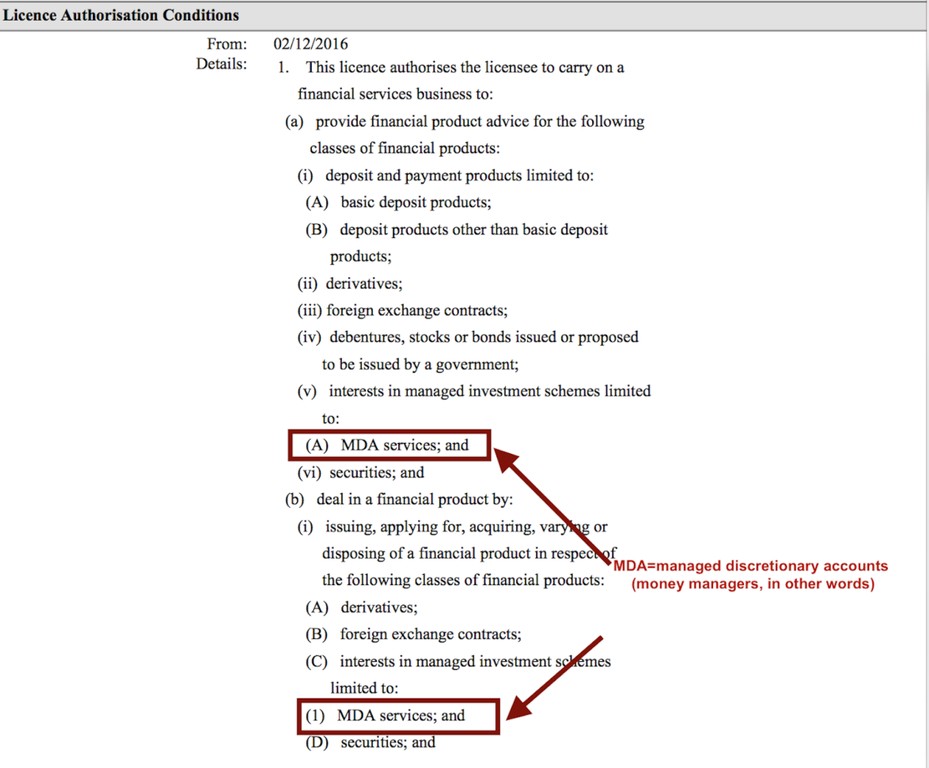

Let’s take a look at another example where the license holder is not authorized to actually execute clients transactions.

While the license is authorized to “deal” in financial products for retail and wholesale clients, it is limited to financial advice and MDA (managed discretionary accounts, or money management activities).

Do not be misled, this is not a brokerage license and could not be used to open trading accounts or pricing and executing client transactions.

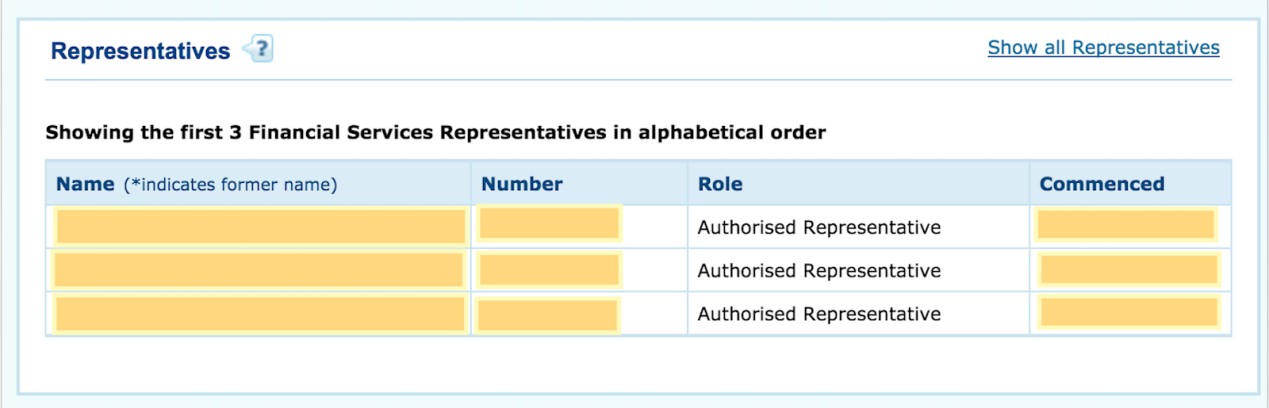

Step 4: Authorized Representatives.

For some AFSL license holders, there may be some names appearing in Representative section

So what is AFS Authorized Representatives under AFSL Licensee?

AFSL License holders may authorize individuals, bodies corporate, partnerships or group of individuals (corporate) that are trustees of a trust of being authorized representatives.

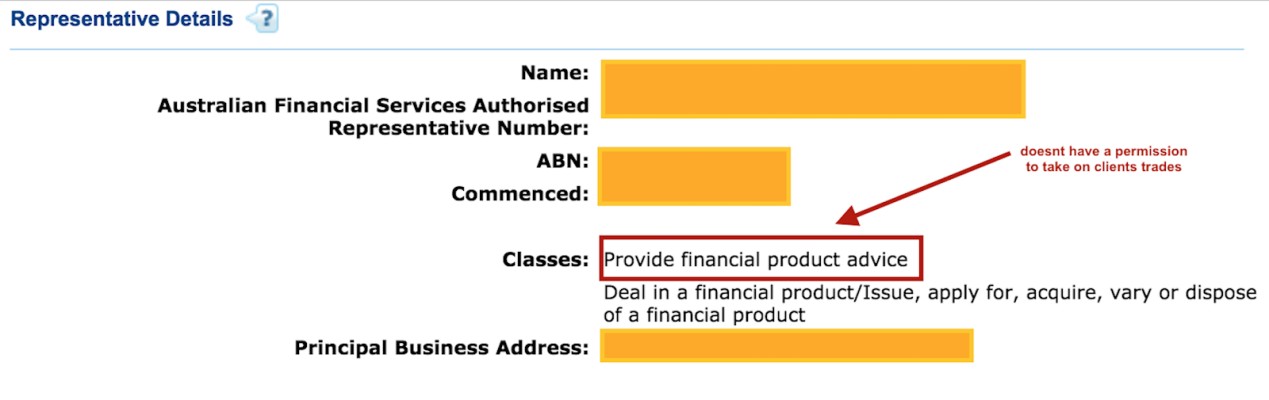

Authorized Representatives can provide a specified financial service or services on behalf of the licensee, but their scope of services are limited by licensee’s license. Therefore, if licensee is not authorized to “make markets”, authorized representative is not able to provides these either.Here is an example:

Contradictory to the popular belief, getting a status of an authorized representative under AFSL licensee doesn’t make a full fledged brokerage operation in Australia.