章節 1 How to Verify Your Broker's FCA License?

1. A Brief introduction to FCA

The Financial Conduct Authority (FCA) is a financial regulatory body in the United Kingdom, operating independently of the UK Government, and is financed by charging fees to members of the financial services industry.

The FCA regulates financial firms providing services to consumers and maintains the integrity of the financial markets in the United Kingdom.It focuses on the regulation of conduct by both retail and wholesale financial services firms.

2. Steps to Verify a FCA License

To verify your broker’s FCA license, please follow this step by step guide.

Step 1

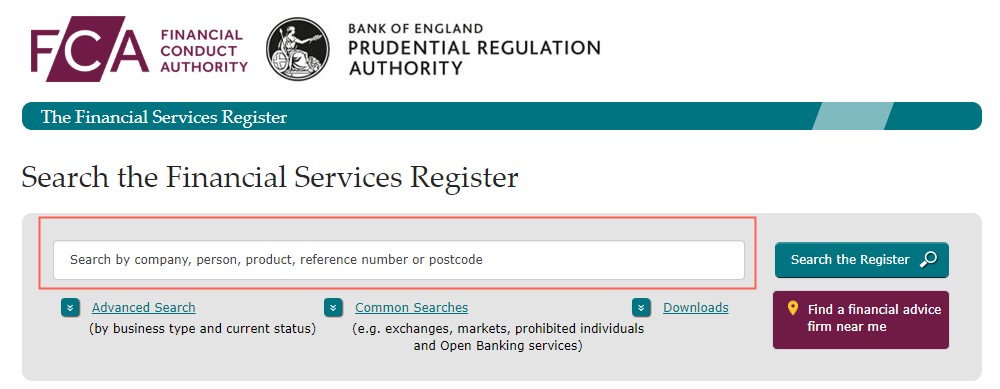

Go to the UK FCA register website:

https://register.fca.org.uk/

and type the company name or license number in the search bar.

Step 2

Confirm its regulatory status and check the business name, address, phone number, Fax, Email and website of the firm to see if they are consistent with the information listed in the website.

Take FXTM for example:

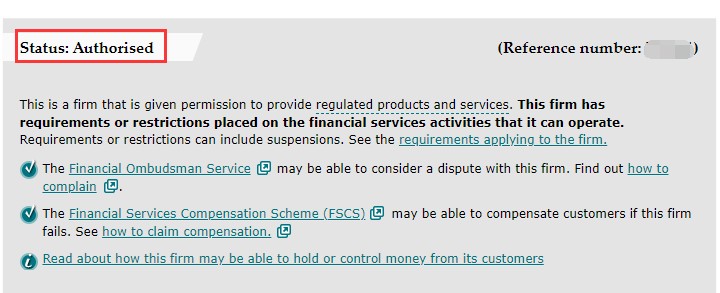

·If the company is licensed in the UK, you will see the following under the status module along with principal place of business address below:

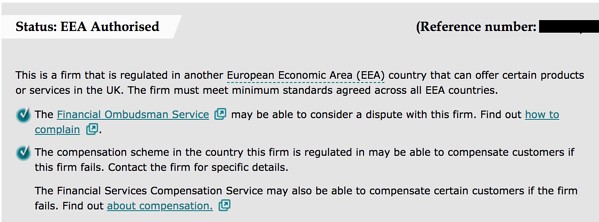

·If the company is authorized in another EEA country and is passporting or has a branch in the UK, you will see EEA authorized under the status and address of the branch office in the UK.

Under the module Regulators you will see in which the regulator for this company of European country is based.

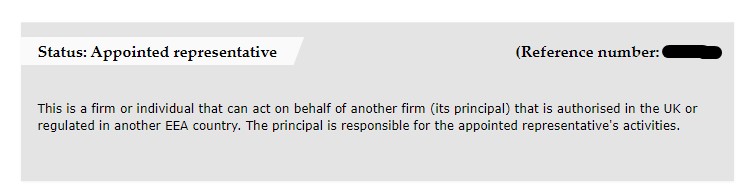

·If the company is the appointed representative of another firm (its principal) that is authorized in the UK or another EEA country, you will see the following status:

·If the company you searched for is no longer authorized by FCA, you will see the following status:

Step 3

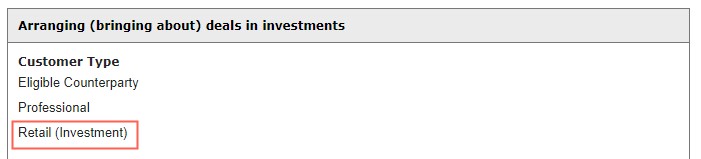

Check what types of clients the firm can accept. It is important to pay attention to this, a lot of brokers claim to be “institutional only” because they want to create an image of a high-end brokerage house, however,it,for the most of time, is just a marketing move designed to attract more sophisticated clients by using a different products or package names.

Under the Module Permissions, go to the section Arranging (bringing about) deals in investments. Below is an example of the firm that is licensed to take all clients, including retail.

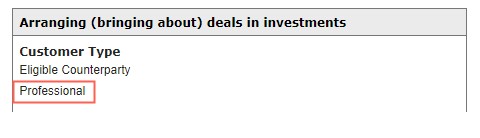

Here is another example of the firm that is authorized to deal with professional investors only:

Step 4

Is the Broker STP (Agency) or Market Maker (Principal)? This one is frequently misrepresented in marketing as brokers often claim that they do not take any risk and that they pass on all of their clients’ trades to the counterparties.

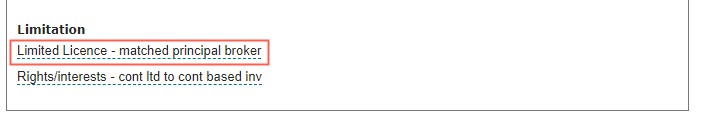

To verify, go to the subsection of the module Permissions entitled Dealing in investments as principal. It will gain list the type of clients that a firm can accept, asset types it’s authorized to deal with, along with limitations/restrictions.

If the broker has the limitation “matched principal” listed here, it means that it is authorized to deal only as an agency broker (STP).

Here is an example of STP broker permission:

And here is an example of the “market maker” broker permission:

Step 5

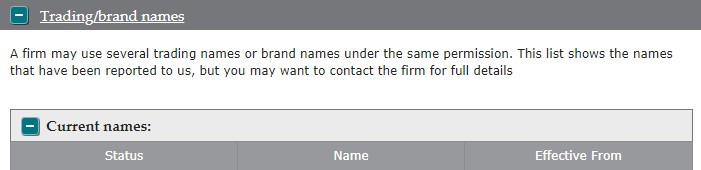

What other brand names does this broker utilize?

Often times brokers use separate brand names to promote different products for different client segments. In order to make sure that you are aware of all the brand names they are doing business under the same permission, check the module Trading/brand names: