Bab 1 Market Analysis Articles March 24

Market Analysis 24th March 2023

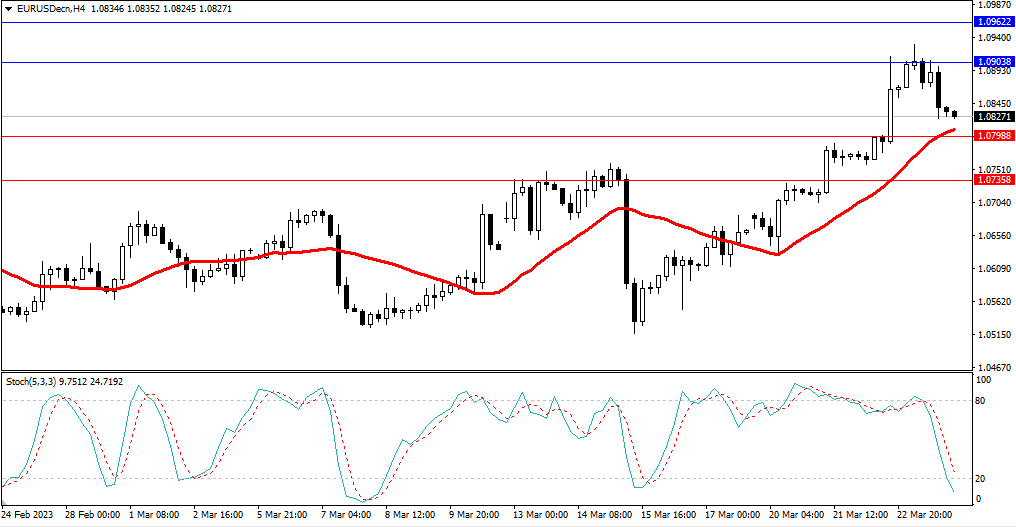

EURUSD

EURUSD able to move higher and reach above our resistance level at 1.0903 before eventually goes back lower. Currently, EURUSD is trading at 1.0824.

At the time of writing, the four-hour Stochastic indicator is moving lower targeting the oversold level. The price is still moving ABOVE the 20-period moving average. For today, we expect EURUSD to continue to move slightly lower and reach our 20-period moving average and support level at 1.0798.

Resistance: 1.0903, 1.0962

Support: 1.0798, 1.0735

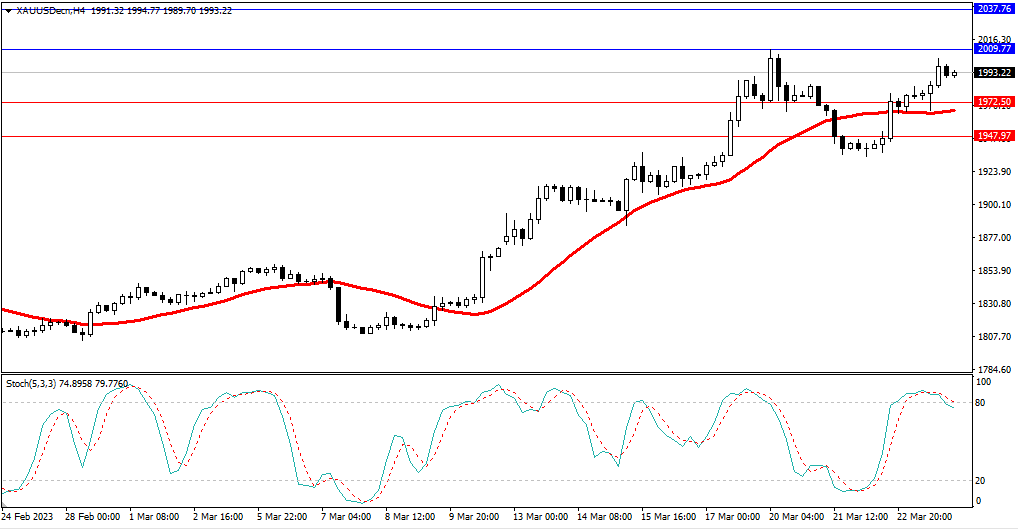

GOLD

Gold able to moves higher and break our resistance level at $1,984 as expected on Thursday. Gold reach as high as $2,003. Currently, gold is trading at $1,993.

At the time of writing, the four-hour Stochastic indicator is moving just inside the overbought level. The price is moving ABOVE the 20-period moving average. For today, we expect that gold might continue to move higher and try to reach our next resistance level at 2009.

Resistance: 2009, 2037

Support: 1972, 1947

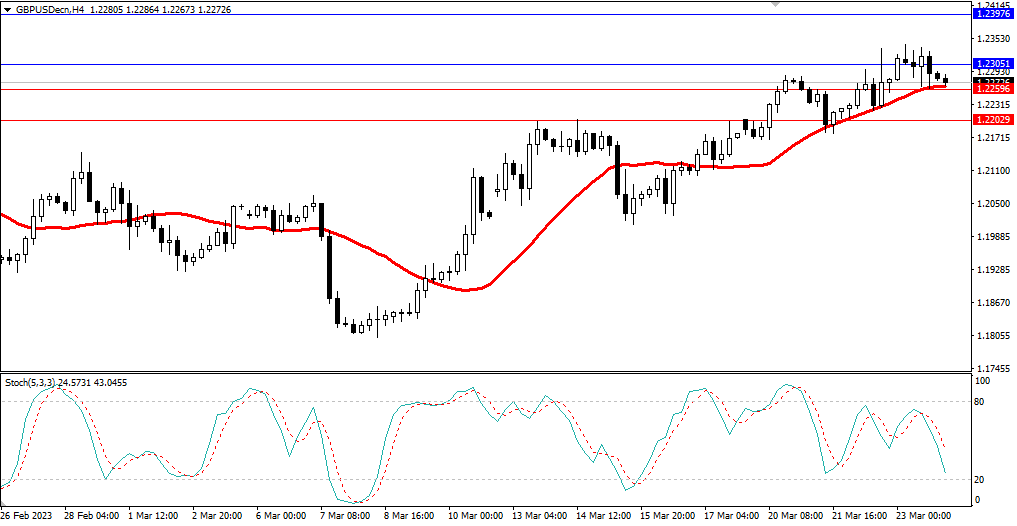

GBPUSD

GBPUSD moves higher on Thursday and able to reach our resistance level at 1.2305 as expected, but then goes back lower and reach our 20-period moving average and support level. Currently, GBPUSD is running at 1.2272.

As of this writing, the four-hour Stochastic indicator is moving lower in the middle. The price is moving just around the 20-period moving average. For today, we expect GBPUSD to move higher and reach back our resistance level at 1.2305.

Resistance: 1.2305, 1.2397

Support: 1.2259, 1.2202

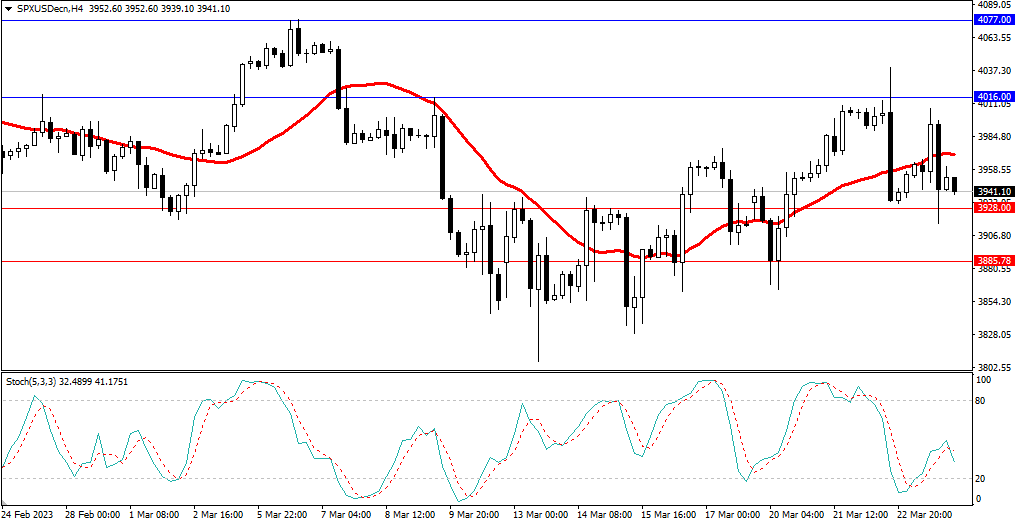

SPXUSD

SPXUSD able to move lower on Thursday and reach below our support level at 3928 as expected but then goes slightly higher. Currently, SPXUSD running at 3941 just above our support level.

As of this writing, the four-hour Stochastic indicator is moving lower in the middle targeting the oversold level. The price is moving BELOW the 20-period moving average. For today, we expect that SPXUSD will move lower and try to break our support level at 3928.

Resistance: 4016, 4077

Support: 3928, 3885

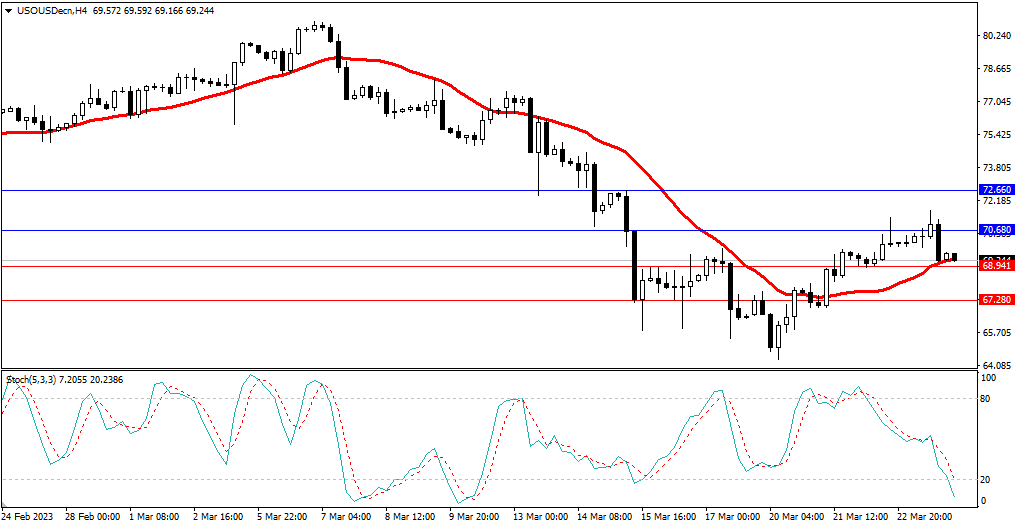

USOUSD

USOUSD (WTI) able to moves higher on Thursday and reach above our resistance level at 70.68 as expected, but the goes back lower. Currently, USOUSD is trading at 69.20 just above our support level.

As of the time of writing, the four-hour Stochastic indicator is moving lower entering the oversold level. The price is still moving at the 20-period moving average. We expect that USOUSD to move lower and break our support level at 68.94.

Resistance: 70.68, 72.66

Support: 68.94, 67.28

Key events for today:

EUR French Flash Manufacturing PMI

EUR French Flash Services PMI

EUR German Flash Manufacturing PMI

EUR German Flash Services PMI

GBP Flash Manufacturing PMI

GBP Flash Services PMI

EUR Euro Summit

USD Flash Manufacturing PMI

USD Flash Services PMI