Bab 21 German PPI Effect 21-11-2022

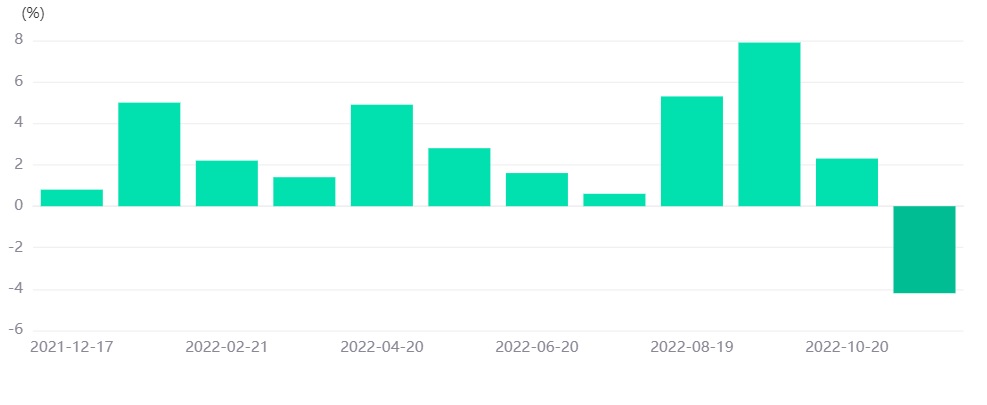

Germany PPI: The German PPI MoM Came at -4.2% less than expected by 5.1% & less than the Previous Result by 6.5%

Summary:

The German economy showed strong volatility following the release of the PPI data on 21-11-2022 at 11:00 AM (GMT +4) with a result of -4.2%. A bullish fundamental signal is already there for the EURUSD.

1. Fundamentals

The German PPI report for October is released on November 21, 2022. The PPI is one of the major monthly indicators that affect the market widely, it measures the change in the price of goods sold by manufacturers. A higher-than-expected data is bullish for the EUR, and lower-than-expected data is bearish for the EUR. The data came out at -4.2%, a decrease of 6.5% from the previous result and 5.1% from the expected result. If everything went as expected bulls will interfere and a major increase in EURUSD will be noted.

EUR is expected to rise to the 1.03800 level breaking the resistance level, but it is expected to recover from further increase in the upcoming days affected by the interest rate decision for December by the FOMC, the interest rate in Europe, U.S – China tensions, and the overall world political situation.

Major traders are holding their positions on EURUSD for further increases in the prices.

German PPI Chart

2. Technical Analysis

Gold Daily Chart

The daily gold pattern shows a bearish engulfing with possible prices touching the 1725 level before bouncing up again.

Support and resistance:

1736.12

1733.80

1730.40

Pivot: 1739.52

1747.56

1745.24

1742.84

3. Trading Recommendations

High Probability Scenario:

Short Below: 1748.00

Support TP1: 1736.00

Support TP2: 1730.00

Alternative Scenario:

Long Above: 1748.00

Resistance TP1: 1753.00

Resistance TP2: 1757.00