Chapter 13 Jul 13th: Dollar Might Take a Breather after Steep Selloff, Swiss Franc Taking the Top Spot

[Following a significant post-CPI sell-off, Dollar's plunge appears to be losing some momentum during today's Asian trading session on oversold conditions.]

Following a significant post-CPI sell-off, Dollar's plunge appears to be losing some momentum during today's Asian trading session on oversold conditions. However, the greenback is yet to demonstrate any considerable signs of a rebound. Investors seem buoyed by the waning likelihood of Fed extending its tightening phase beyond the imminent July interest rate hike. As it stands, Fed fund futures are reflecting less than 30% chance for further rate hikes throughout the remainder of the year. In sync with this development, major Asian stock indexes are showing considerable gains, riding on the coattails of US market rally overnight.

New Zealand and Australian Dollar are the stronger ones for today. followed by Swiss Franc. Meanwhile, Dollar, Yen and Canadian are the worst. But for the week, Swiss Franc is the top gainer at this point, helped by EUR/CHF breaking through a key near term support level. Yen is still strong as the second, but got its first place taken by the Franc. Canadian Dollar is the second worst following Dollar despite yesterday's BoC rate hike. Euro is having a slight advantage over Sterling while Aussie and Kiwi are mixed.

Technically, EUR/CHF's dive through 0.9670 support confirms resumption of whole decline from 1.0095. The structure of the fall still suggests that it's a corrective move. But deeper decline would remain in favor as long as 0.9721 support turned resistance holds. Next target is 100% projection of 0.9995 to 0.9670 from 0.9840 at 0.9515. If realized, the extended fall in EUR/CHF would make USD/CHF short a better trade than EUR/USD long.

In Asia, at the time of writing, Nikkei is up 1.40%. Hong Kong HSI is up 2.32%. China Shanghai SSE is up 0.99%. Singapore Strait Times is up 1.75%. Japan 10-year JGB yield is down -0.0080 at 0.472. Overnight, DOW rose 0.25%. S&P 500 rose 0.74%. NASDAQ rose 1.15%. 10-year yield dropped -0.119 to 3.861.

Fed Beige Book: Slight increase in economic activity and modest price rises

Fed's Beige Book report noted that the "overall economic activity increased slightly since late May." Notably, the level of economic development varied across the twelve districts, with five districts reporting growth, five noticing no change, and two marking modest declines.

The Beige Book described a cautiously optimistic picture for the future, stating that "overall economic expectations for the coming months generally continued to call for slow growth."

Despite the uneven growth rate, the districts generally agreed on the direction of price changes. The report noted that "prices increased at a modest pace overall, and several districts noted some slowing in the pace of increase."

Looking ahead, the report suggests that the "price expectations were generally stable or lower over the next several months".

The employment situation was characterized by a modest rise, with the Beige Book stating that "employment increased modestly this period, with most districts experiencing some job growth."

NZ BNZ PMI fell to 47.5, sector remains entrenched in contraction

New Zealand's manufacturing sector is experiencing a continuous contraction according to BusinessNZ Performance of Manufacturing Index. The Index showed a drop from 48.7 in May to 47.5 in June, marking another month of activity below the crucial 50.0-point mark which separates expansion from contraction.

An analysis of the sub-indices revealed mixed performances across different facets of the sector. While production showed a modest rise from 46.0 to 47.5, new orders experienced a significant drop from 50.2 to 43.8. Meanwhile, employment levels decreased from 49.3 to 47.0. Both finished stocks and deliveries saw rises, from 51.6 to 52.2 and 46.1 to 50.5 respectively.

Alongside this contraction in activity, the report noted an increase in negative sentiment among manufacturers. In June, the proportion of negative comments increased to 74.5%, up from 66.7% in May and 70.3% in April. According to manufacturers, the primary negative influences on current activity are declining demand, inflationary pressures, and issues surrounding production and staffing.

BusinessNZ's Director, Advocacy Catherine Beard, pointed out the persisting contraction in the sector, saying, "the sector remains entrenched in contraction, with eight of the last ten months showing overall activity below the 50.0-point mark."

China's exports down -12.4% yoy in Jun, imports down -6.8% yoy

China's trade dynamics in June spun a story of steeper than expected declines on both the import and export front. With the largest export drop since February 2020.

June's figures reveal a -12.4% yoy slump in China's exports, far exceeding anticipated -9.5% yoy decline and outpacing May's -7.5% yoy drop. Imports followed a similar pattern, decreasing by -6.8% yoy, steeper fall than projected 4.0% and more significant contraction than May's -4.5% yoy shrinkage.

Despite these challenges, China's trade surplus managed to grow from USD 68.1B to USD 70.62B. However, this increase didn't quite hit expectation of a USD 74.8B surplus.

Lu Daliang, a spokesperson for China's customs bureau, cautioned that the nation's trade is expected to face substantial pressure in the second half of the year. During a press conference, Lu attributed these pressures to high inflation in developed countries and geopolitical issues.

Looking ahead

UK GDP, production and goods trade balance; Eurozone industrial production, and ECB meeting accounts are the main highlights in European session. US will release jobless claims and PPI later in the day.

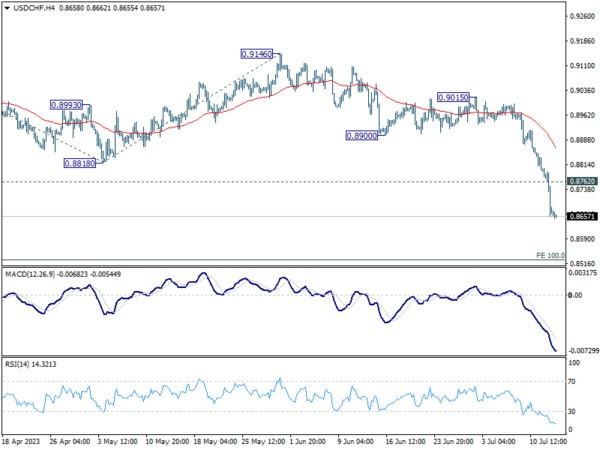

USD/CHF Daily Outlook

USD/CHF hits as low as 0.8650 so far today and intraday bias stays on the downside. Current fall should target 100% projection of 0.9439 to 0.8818 from 0.9146 at 0.8525 next. On the upside, above 0.8762 minor resistance will turn intraday bias neutral and bring consolidations first. But outlook will remain bearish as long as 0.8900 support turned resistance holds.

In the bigger picture, the break of 0.8756 (2021 low) indicates break out from the long-term range pattern. For now, medium term outlook will stay bearish as long as 0.9146 resistance holds. Further fall would be seen to 61.8% retracement of 0.7065 (2011 low) to 1.0342 (2016 high) at 0.8317 next.

Source: ActionForex.com