Chapter 5 Jul 7th: Risk-Off Sentiment Grips Markets ahead of NFP, But Currencies Mixed

[Markets are firmly entrenched in a risk-off mode as focus shifts to impending U.S. Non-Farm Payroll data.]

Markets are firmly entrenched in a risk-off mode as focus shifts to impending U.S. Non-Farm Payroll data. Expectations for two additional Fed hikes have been gaining traction this week following a string of strong employment data. The deep pullback in U.S. equities overnight extended into Asian trading hours. Concurrently, benchmark 10-year yield managed to close above 4% level and continues to remain strong in Asia. Despite these significant developments, the currency markets are yet to reflect the shifts in sentiment noticeably.

At the moment, New Zealand Dollar stands out as the week's top performer, while its fellow commodity currencies, Canadian and Australian Dollars, find themselves at the opposite end of the spectrum. Both Euro and Swiss Franc are leaning towards weakness, whereas Sterling shines as the second-best performer. Dollar's performance appears mixed, with Yen showcasing slight outperformance, even amidst the robust surge in U.S. yields. Today's job data is expected to provide a more precise directional cue for currencies for the remainder of the month.

From a technical perspective, the USD/CAD pair is one to watch, particularly as both U.S. and Canada are slated to release their job data today. It's now pressing 55D EMA (now at 1.3369) as rebound form 1.3115 short term bottom accelerated higher yesterday. Sustained break of this EMA will bolster the case that could corrective pattern from 1.3976 has completed with three waves down to 1.3115. In this case, stronger rally would be seen back to 1.3860/3976 resistance zone later in the month. Meanwhile, rejection by the EMA will maintain near term bearishness through 1.3115 low at a later stage. We'll know which one it goes pretty soon.

In Asia, at the time of writing, Nikkei is down -0.54%. Hong Kong HSI is down -1.03%. China Shanghai SSE is down -0.36%. Singapore Strait Times is down -0.38%. Japan 10-year JGB yield is up 0.0304 at 0.442. Overnight, DOW dropped -1.07%. S&P 500 dropped -0.79%. NASDAQ dropped -0.82%. 10-year yield rose 0.096 to 4.041.

BoJ's Uchida cautions against premature policy shift

BoJ Deputy Governor Shinichi Uchida voiced caution over a hasty shift in monetary policy amid current economic climate. In an interview with Nikkei, Uchida emphasized that Japan was far from needing to hastily raise interest rates.

"The risk of missing the opportunity to achieve our 2% target with a premature policy shift is bigger than that of being too late in tightening policy and allowing inflation to continue running above 2%," Uchida explained.

Uchida noted the budding changes in Japanese companies' behavior, which have been rooted in the country's deflationary period. He stressed the importance of nurturing these developments with care. However, he cautioned that uncertainty remains high over inflation outlook, including impact of pricing behaviors and wage hikes by companies.

"We have not reached a point where we can foresee the 2 percent price stability target can be attained stably and sustainably," Uchida said. He also recognized the burden placed on households due to more than 2% rise in core CPI, reinforcing the importance of supporting the economy with current monetary easing to stabilize inflation at 2%, in tandem with wage growth.

Uchida also touched on foreign exchange rates, noting the unwanted uncertainty caused by Yen's rapid and one-sided depreciation. He highlighted the importance of stable foreign exchange rates, which should reflect economic and financial fundamentals. "The BOJ will coordinate with the government, and closely monitor developments in the foreign exchange market and their impact on the economy and prices," he added.

Japan's nominal wages surge, yet real wages and household spending stumble

Japanese workers saw their nominal wages surge 2.5% yoy in May, significantly surpassing expected increase of 1.2% yoy. Regular pay, which includes basic salaries, rose by an impressive 1.8% yoy, marking the highest gain since February 1995. Meanwhile, overtime and other non-regular pay saw a modest increase of 0.4% yoy, while special pay including bonuses skyrocketed by 22.2% yoy.

However, inflation-adjusted real wage index tells a different story. It dropped by -1.2% yoy in May, marking a 14-month declining streak. The reduction, nonetheless, was less severe than -3.2% yoy drop experienced a month earlier. This appears to mirror the effects of pay raise agreements established during this year's "shunto" spring labor-management negotiations.

Despite these wage increases, separate data revealed that Japanese household spending fell -4.0% yoy in May, outpacing median market forecast for a -2.4% yoy drop. This decline extended for the third month and affected a range of expenses from food to clothing to transportation. On a seasonally adjusted monthly basis, household spending dipped by -1.1% mom, this represents the fourth consecutive month of decline.

Bets on two more Fed hikes gaining traction ahead of NFP

Financial markets are awaiting with bated breath today's U.S. non-farm payrolls data, as labor market tightness continues to be a crucial variable in shaping Fed future policy trajectory. Market consensus predicts a healthy growth of 220k jobs in June, while unemployment rate is forecast to remain steady at 3.70%. Average hourly earnings are projected to see a moderate increase of 0.3% mom.

With the backdrop of this week's related data, risks appear to be tilted towards a positive surprise. ADP reported private employment growth of 497k, which is almost double the anticipated 250k. ISM services employment bounced back from 49.2 to 53.1, while ISM manufacturing employment slipped from 51.4 to 48.1. The robust surge in service sector seems capable of more than compensating for the downturn in manufacturing sector.

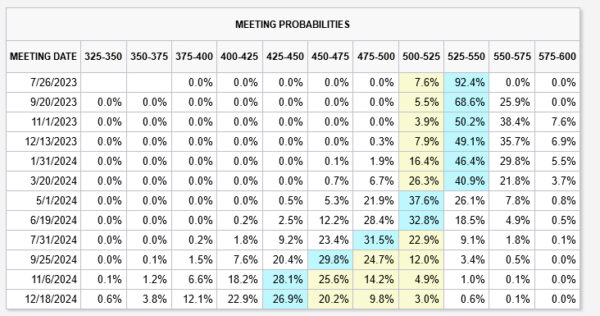

Ahead of the job report, Fed funds futures are pricing in a 92.4% likelihood of an additional 25 bps hike, which would bring rates to 5.25-5.50% at FOMC meeting in July.

Market participants appear to remain somewhat skeptical of FOMC members' "strong majority" opinion that two or more rate hikes are necessary in 2023. However, probability of more tightening beyond July is gaining traction. Chance of interest rate reaching 5.50-5.75% in November currently stands at 46%.

Simultaneously, expectation for the first-rate cut continues to be deferred, with odds remaining below 50% until March 2024.

Elsewhere

Swiss unemployment rate and foreign currency reserves, Germany industrial production, France trade balance and Italy retail sales will be released in European session. Canada will also publish job data in U.S. session.

USD/JPY Daily Outlook

Intraday bias in USD/JPY remains neutral at this point. Correction from 145.06 is in progress and break of 143.54 will turn bias to the downside for deeper fall. Still, overall outlook remains bullish with 140.90 resistance turned support intact. Break of 145.06 will resume larger rise to 161.8% projection of 127.20 to 137.90 from 129.62 at 146.93.

In the bigger picture, rise from 127.20 is currently seen as the second leg of the corrective pattern from 151.93 high. Further rally is expected as long as 138.75 support holds, to retest 151.93. But strong resistance could be seen there to limit upside. Break of 138.75 will indicate the the third leg has started back towards 127.20.

Source: ActionForex.com