Chapter 6 How to Verify Your Broker’s Offshore License?

1. A Brief Introduction to Offshore Regulation

The regulation condition in the mainstream regulatory, like FCA, ASIC and NFA became all the more stringent recent years, offshore regulation came as a new haven for Forex brokers, where the regulatory drive is softer.

For the retail trader, the criteria used to analyze the broker is the same, but opening a trading account in a different jurisdiction may offer more advantages.

Under such trend, offshore regulations get popular, among them are International Financial Services Commission (IFSC) in Belize, Vanuatu Financial Services Commission (VFSC) in Vanuatu, Cayman Island Monetary Authority (CIMA) in Cayman, Malta Financial Service Authority(MFSA) in Malta, and International Business and Financial Center, Malaysia (Labuan IBFC).

2. Steps to Verify a Offshore License

Here we’ll only cover there typical offshore regulatory—IFSC,VFSC and CIMA.

1) Belize’s IFSC License

Step 1

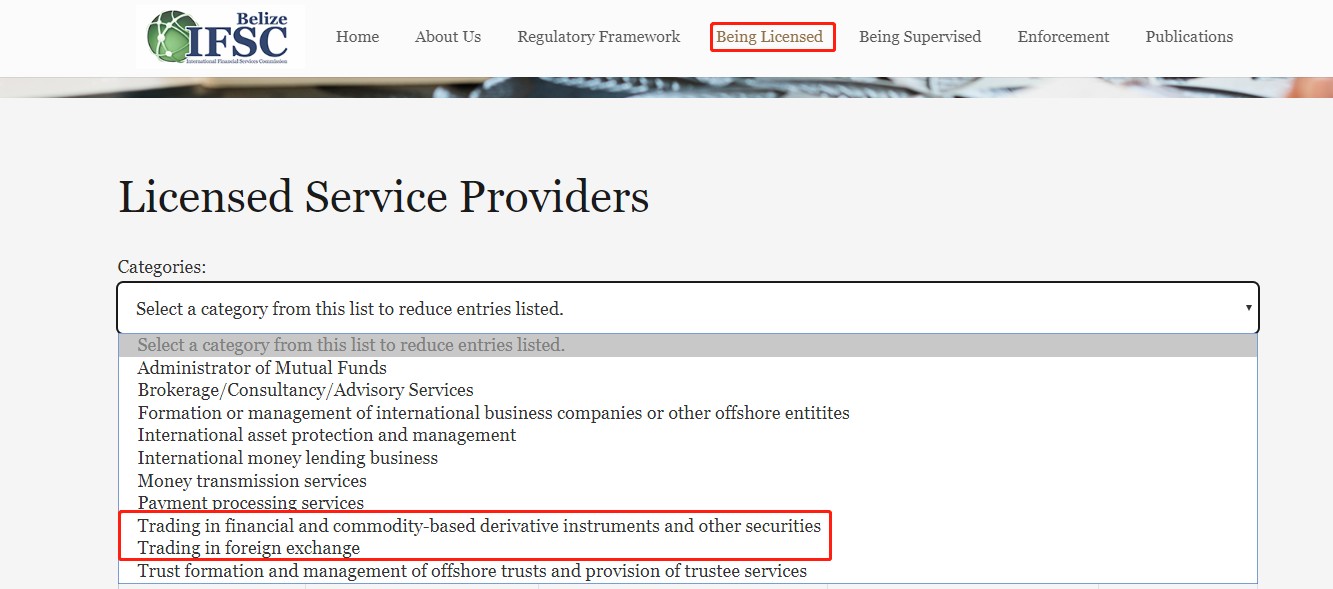

Go to the Belize IFSC’s website:

https://www.ifsc.gov.bz/

and click into the License Service Providers under Being Licensed module.

Step 2

Select “Trading in financial and commodity-based derivative instruments and other securities” or “Trading in foreign exchange” categories in the search bar.

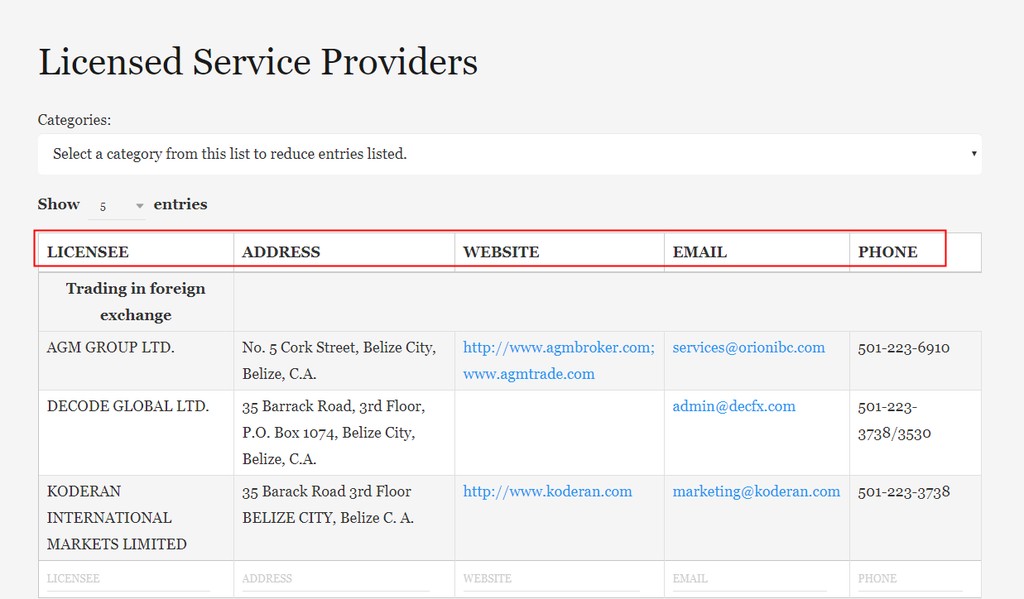

Step 3

Check the name, address, website, e-mail and phone number of the company to see if they are consistent with the information listed in the website you are trading with.

2) Vanuatu’s VFSC License

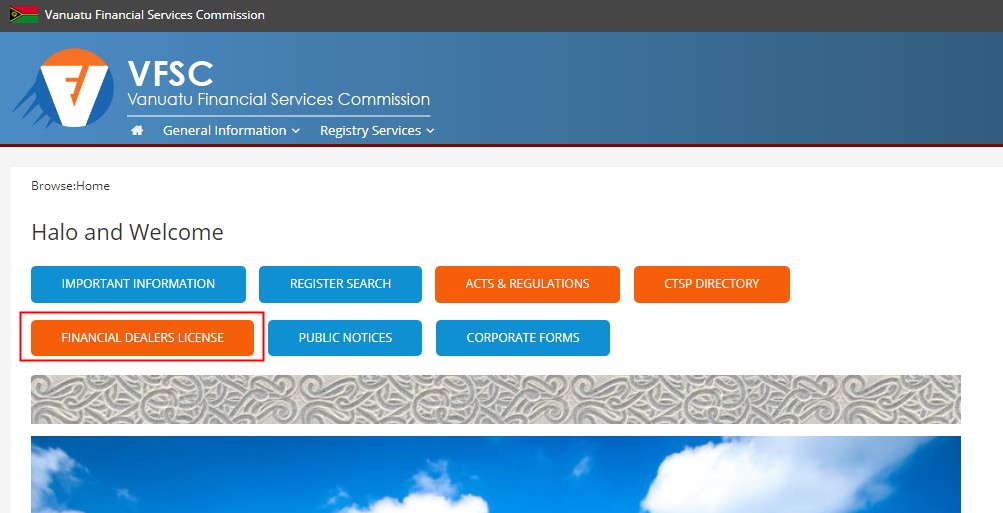

Step 1

Go to the Vanuatu VFSC’s website:

https://www.ifsc.gov.bz/

and click into the Financial Dealers License module.

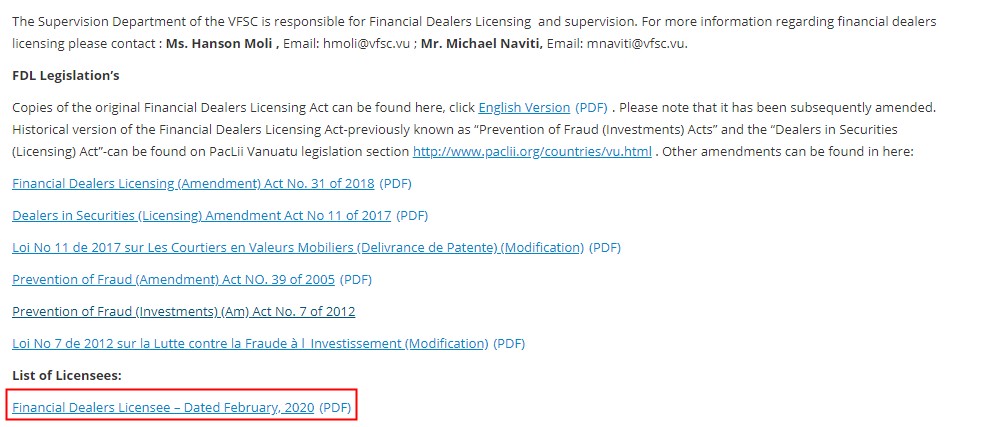

Step 2

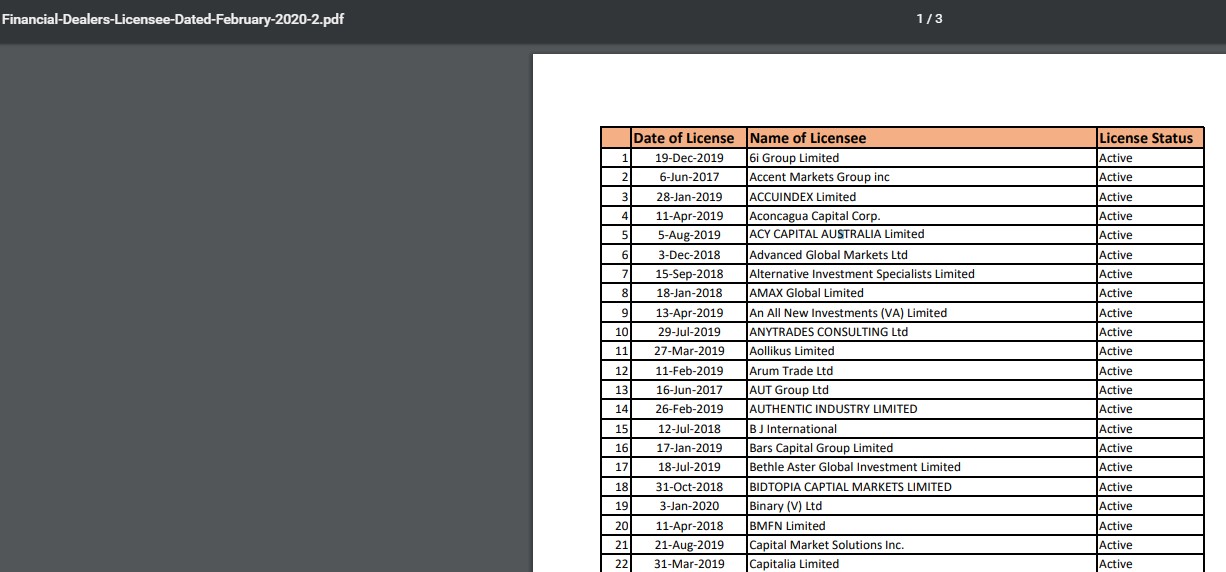

Click into the Financial Dealers Licensee under the List of Licensees module.Please note that this list updates every month.

Step 3

Check the name and regulatory status of the broker you are searching for.

3) Cayman’s CIMA License

Step 1

Go to the Cayman CIMA’s website:

https://www.cima.ky/

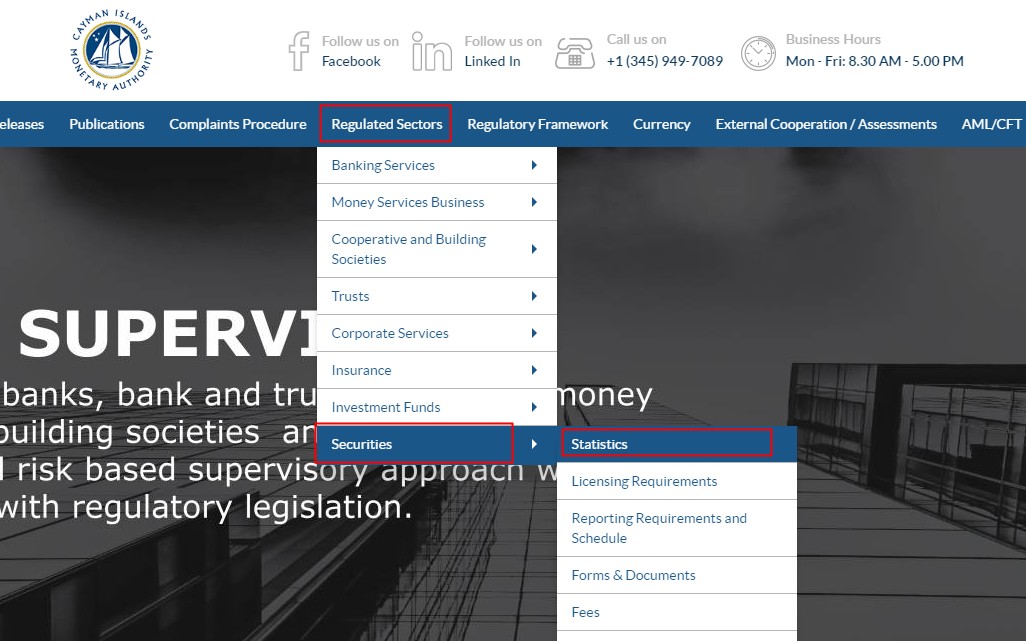

and click into the Statistics module under Securities section of Regulated Sectors .

Step 2

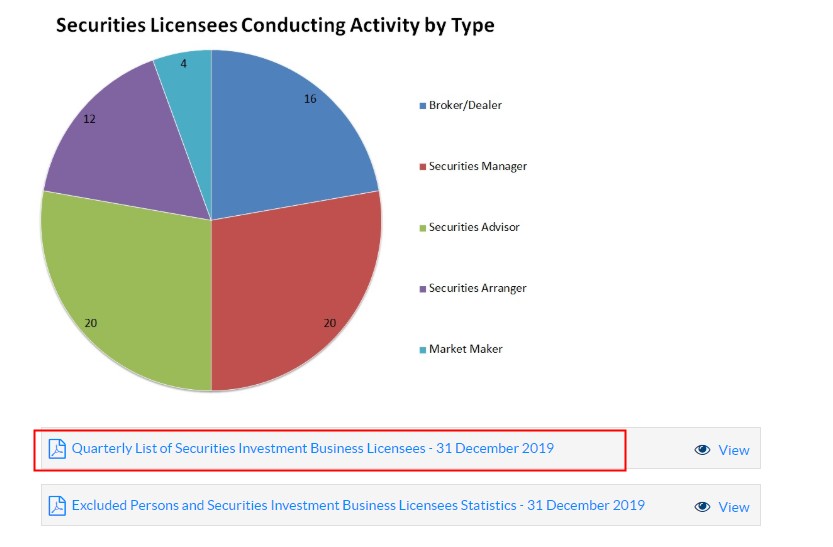

Click into the list of securities investment business licensees.

Step 3

Check the name of the broker you are searching for.You can also figure out what kind of business your broker was registered to operate here.

3. Keeping an eye when choosing offshore regulated broker

Opening a Forex account under a offshore regulated broker allows retail investors to trade unrestricted by leverage and other requirements. However, in many cases, the risks may outweigh the benefits.

For example, counterparty risk may increase as the offshore regulation is loose, and the offshore regulated broker may not be of the highest standards. Detecting and preventing fraud be difficult and scams may be more common. Also, competition may not exist in these foreign markets, so getting the best pricing may be to the advantage of the broker and not the trader.

Therefore, when choosing a offshore regulated broker, a trader needs to determine whether the potential for higher leverage is worth the risks of forgoing the protections established by the mainstream regulators.