Chapter 6 Order Types

The term “order” refers to how you will enter or exit a trade.Here we discuss the different types of orders that can be placed in the Forex market.

Different brokers accept different types of Forex orders.So be sure that you know which types of orders your broker accepts.

There are some basic order types that all brokers accept: Market order, Pending order, Stop Loss and Take Profit.

1. Market Order

Market order is a commitment to the broker to buy or sell a currency pair at the current price. Execution of this order results in opening of a trade position. currency pair are bought at ask price and sold at bid price. Stop Loss and Take Profit orders (described below) can be attached to a market order. Execution mode of market orders depends on currency pair traded.

2. Pending Order

Pending order is the traders’ commitment to the broker to buy or sell a currency pair at a pre-defined price in the future. This type of orders is used for opening of a trade position provided the future quotes reach the pre-defined level. There are four types of pending orders available:

·Buy Limit – buy provided the future "ask" price is equal to the pre-defined value. The current price level is higher than the value of the placed order. Orders of this type are usually placed in anticipation of that the price, having fallen to a certain level, will increase;

· Sell Limit – sell provided the future "bid" price is equal to the pre-defined value. The current price level is lower than the value of the placed order. Orders of this type are usually placed in anticipation of that the price, having increased to a certain level, will fall;

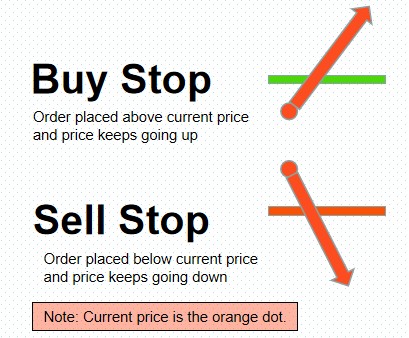

· Buy Stop – buy provided the future "ask" price is equal to the pre-defined value. The current price level is lower than the value of the placed order. Orders of this type are usually placed in anticipation of that the price, having reached a certain level, will keep on increasing;

·Sell Stop – sell provided the future "bid" price is equal to the pre-defined value. The current price level is higher than the value of the placed order. Orders of this type are usually placed in anticipation of that the price, having reached a certain level, will keep on falling.

3. Stop Loss

This order is used for minimizing of losses if the price has started to move in an unprofitable direction. If the price reaches this level, the position will be closed automatically. Such orders are always connected to an open position or a pending order.

Trading terminal checks long positions with bid price for meeting of this order provisions (the order is always set below the current bid price), and it does with ask price for short positions (the order is always set above the current ask price).

To automate Stop Loss order following the price, one can use Trailing Stop.

4. Take Profit

Take Profit order is intended for gaining the profit when the price has reached a certain level. Execution of this order results in closing of the position. It is always connected to an open position or a pending order. The order can be requested only together with a market or a pending order.

Trading terminal checks long positions with bid price for meeting of this order provisions (the order is always set above the current bid price), and it does with ask price for short positions (the order is always set below the current ask price).