Chapter 37 U.S. Initial Jobless Claims 05-01-2023

U.S Initial Jobless Claims: The U.S Initial Jobless Claims is Expected to Come at 230K More than the Previous Result by 5K, Gold is Expected to Increase Further

Summary:

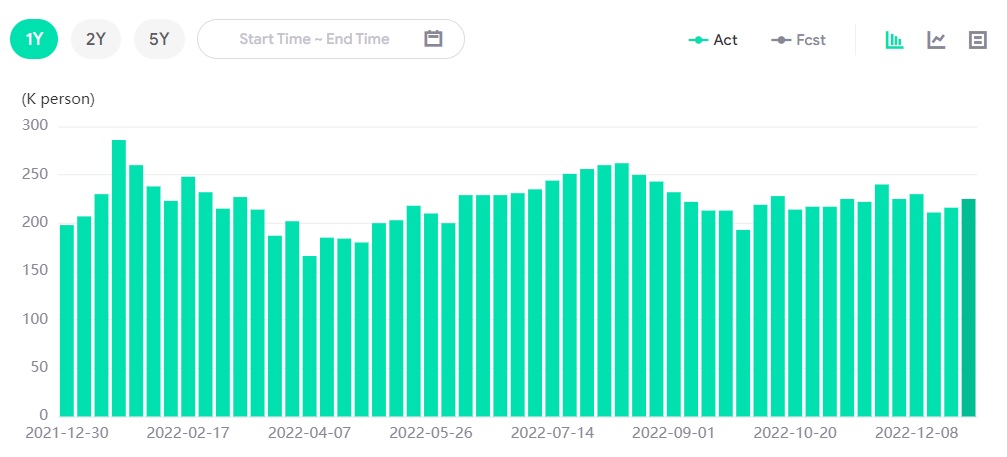

The U.S. economy will show strong volatility after releasing the U.S Weekly Jobless Claims data on 05-01-2023 at 5:30 PM (GMT +4) with an expected result of 230K. If as expected, we might see a huge increase in gold prices and a major drop in DXY.

1. Fundamentals

The U.S Weekly Initial Jobless Claims report will be released on January 5, 2023. The Jobless Claims is one of the major monthly indicators that affect the market widely, it measures the number of individuals who filed for unemployment insurance for the first time during the past week. A higher-than-expected data is bearish for the dollar, and lower-than-expected data is bullish for the dollar. The data is expected to come out at 230K, more than the previous result. If everything went as expected bears will interfere and a major drop in DXY will be noted.

Gold is expected to rise to the 1830-1835 level breaking the resistance level, but it is expected to recover in the upcoming days affected by the 2023 interest rate projections, the interest rate in Europe, U.S – China tensions, and the overall world political situation.

Major traders are holding their Gold positions for further price increases.

U.S Initial Jobless Claims Chart

2. Technical Analysis

Gold Daily Chart

The daily gold pattern shows a bullish engulfing with possible prices touching the $1835 level.

Support and resistance:

1818.75

1813.67

1811.05

Pivot: 1821.37

1834.15

1829.07

1826.45

3. Trading Recommendations

Trading Direction: Long

Entry Price: 1810.00

Target Price: 1860.00

Stop Loss: 1790.00