Chapter 27 Switzerland Unemployment Rate

EU – Switzerland Unemployment Rate (November) Came Lower than Expected at 2.0% rather than 2.1%

Summary:

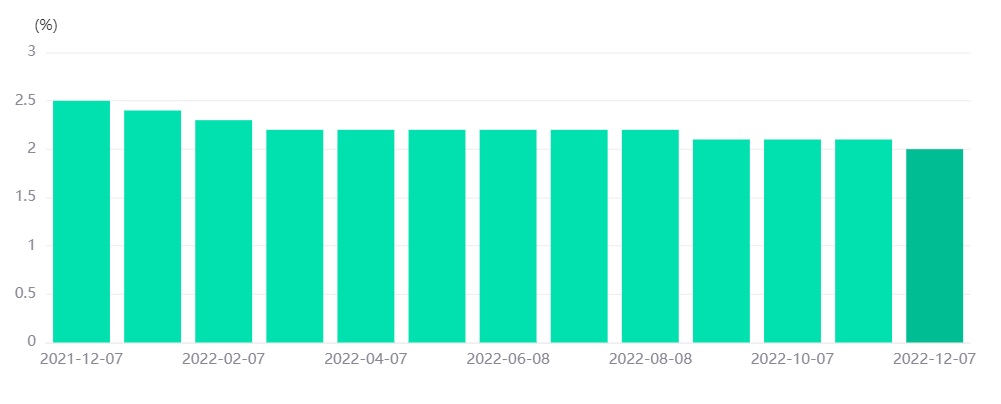

Eyes and Ears were on today’s Switzerland unemployment indicator decision. The unemployment index was previously 2.1% and was expected to come at 2.1% as well on December 7th, 2022, but the actual result came to be 2.0%. A higher-than-expected reading is considered Bearish for the CHF, and a lower-than-expected reading is considered bullish for the CHF.

Recommended Entry Price:

EURUSD:

Entry Price: 1.04800

Target Price: 1.05800

SL Price: 1.04250

1. Fundamentals

In today’s article, we will discuss the unemployment rate’s effect on the market. To start with, the unemployment rate represents the number of unemployed persons expressed as a percentage of the labor force. A lower-than-expected reading is considered bullish for the CHF, and a more-than-expected reading is considered bearish for the CHF. It is considered an important indicator, not only for Switzerland’s economy, but it indicates the major trend of the EU economy.

Switzerland’s unemployment rate was announced earlier on December 7th, 2022, with a result of 2.0% instead of a forecasted result of 2.1%. The result was lower than expected, thus it is bullish for the EUR. EURUSD prices increased sharply after this indicator by 50 PIPS from 1.0456 to 1.0505.

Switzerland’s Unemployment Rate

2. Technical Analysis

EURUSD Intraday:

The Intraday EURUSD pattern shows a bullish engulfing on M15 with possible prices touching the 1.05600 level later today.

Support and resistance:

1.0485

1.0479

1.0469

Pivot: 1.0495

1.0517

1.0511

1.0501

3. Trading Recommendations

High Probability Scenario:

Short Below: 1.04524

Target 1: 1.04307

Target 2: 1.04060

Alternative Scenario:

Long Above: 1.04842

Target 1: 1.05013

Target 2: 1.05194