Chapter 14 EU - Eurozone Retail Sales MoM & YoY

EU – Eurozone Retail Sales MoM & YoY

Summary:

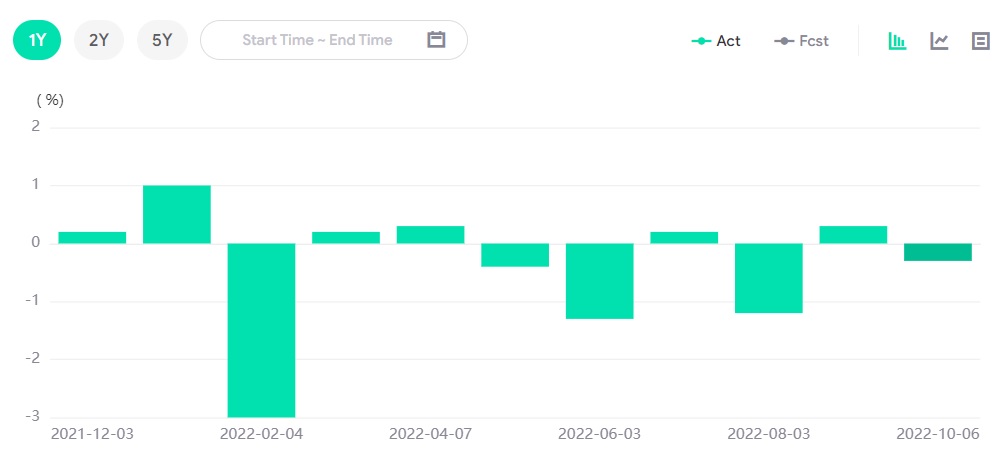

Eyes and Ears on today’s EU retail sales indicator decision. The retail sales MoM index was previously -0.3% and is expected to come at 0.4% and YoY was -2% and is expected to come at -1/3% on November 8th, 2022. A higher-than-expected reading is considered Bullish for the EUR, and a lower-than-expected reading is considered bearish for the EUR.

1. Fundamentals

In today’s article, we will discuss the retail sales effect on the market. To start with, retail sales measure the change in the total value of inflation-adjusted sales at the retail level. It is the foremost indicator of consumer spending that accounts for the majority of the overall economic activity. A lower-than-expected reading is considered bearish for the EUR, and a more-than-expected reading is considered bullish for the EUR. It is considered an important indicator as it indicates the major trend of the EU economy.

Eurozone Retail Sales will be announced on November 8thth, 2022. On October 6th, Eurozone Retail Sales MoM came out to be -0.3% up from -0.4% and a forecast of 0.4%. The result was bullish for the EUR, and a major drop in the EURUSD pair was monitored constituting of 35 PIPS.

In today’s result, if the Eurozone Retail Sales came higher than expected it will come bullish for the EUR, and Dollar Index will further decrease. If the results came lower than expected, it will go bearish for the EUR, and the dollar index will see an increase in prices.

Eurozone Retail Sales MoM (October)

Technical Analysis

Gold Intraday:

The Intraday Gold pattern shows a bearish engulfing on M30 with possible prices touching the $1658.00 level later today.

Support and resistances:

1665.23

1663.36

1660.52

Pivot: 1668.20

1674.70

1673.00

1670.80

2. Trading Recommendations

High Probability Scenario:

Short Below: 1666.00

Target 1: 1662.00

Target 2: 1658.00

Alternative Scenario:

Long Above: 1675.00

Target 1: 1681.00

Target 2: 1687.00