章节 8 Jul 13th: Global Tin Stocks at Two-Year Highs After LME Squeeze

[The amount of tin sitting in London Metal Exchange (LME) warehouses has more than doubled in the space of a month.]

The amount of tin sitting in London Metal Exchange (LME) warehouses has more than doubled in the space of a month.

Metal has been arriving almost daily in response to a sharp squeeze across the front part of the LME tin curve.

The cash premium over three-month delivery flared out to $1,704 per metric ton in June, the widest it's been since October 2021.

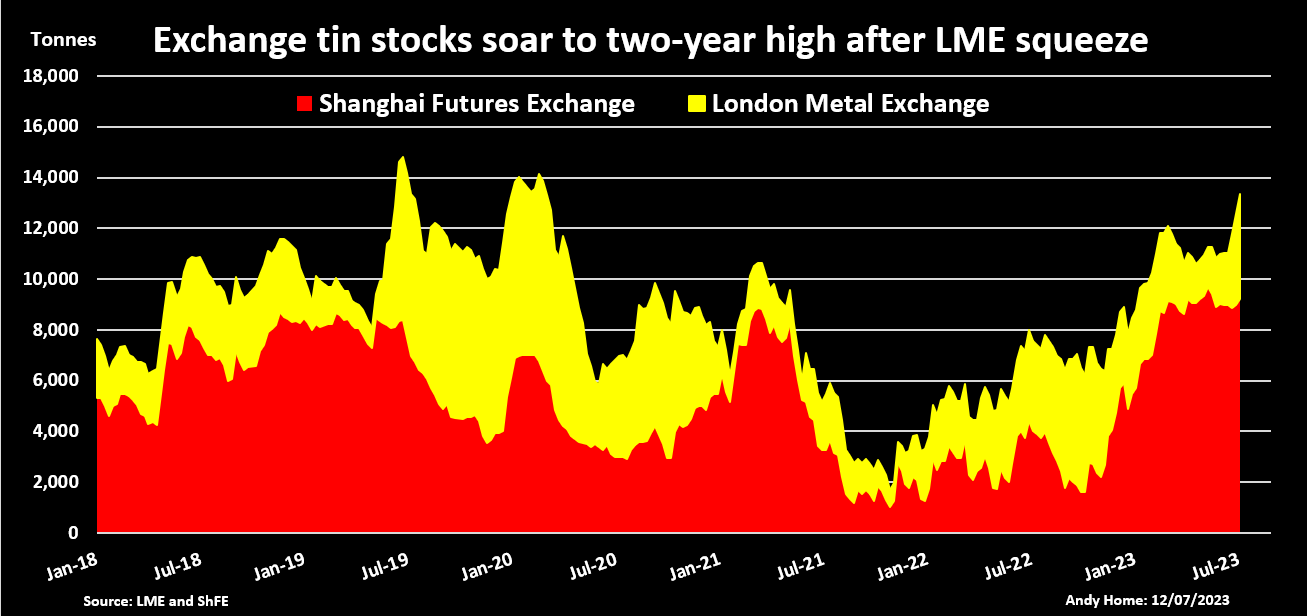

The tightness is now dissipating, but it has served to lift LME inventories to an eight-month high of 4,305 metric tons.

Shanghai Futures Exchange (ShFE) stocks have been rebuilding since the start of the year and currently stand at 9,203 metric tons. Total exchange stocks are now the highest since March 2020.

It's a big turnaround for a market that was experiencing acute scarcity just a year or so ago, and attests to weak demand from the electronics sector.

But with supply disruption looming in Myanmar, the market may need some inventory cushion.

LME Squeeze, But No Physical Tightness

The tightness on the LME tin contract does not seem to have reflected any shortage of tin in the physical market.

The high cash premium has drawn in metal at multiple LME warehouse locations.

Deliveries have been concentrated at Malaysia's Port Klang and Singapore, but tin has also been warranted in Rotterdam, Antwerp, the Italian ports of Genoa and Trieste, the Spanish port of Bilbao and the U.S.

The warranting of 515 metric tons at Baltimore is particularly telling, given the U.S. market was so tight in 2021 that buyers were paying an eye-watering $4,000 per metric ton over the LME price to get metal.

The Midwest premium is now assessed by Fastmarkets at $1,550 per metric ton, making delivery onto the LME a viable option.

It is clear the physical supply chain has refilled over recent months, thanks to producers recovering from COVID-19 disruption and demand from the soldering sector remaining subdued.

The LME squeeze appears to have been more a clash of positioning in what can at times be a relatively illiquid market.

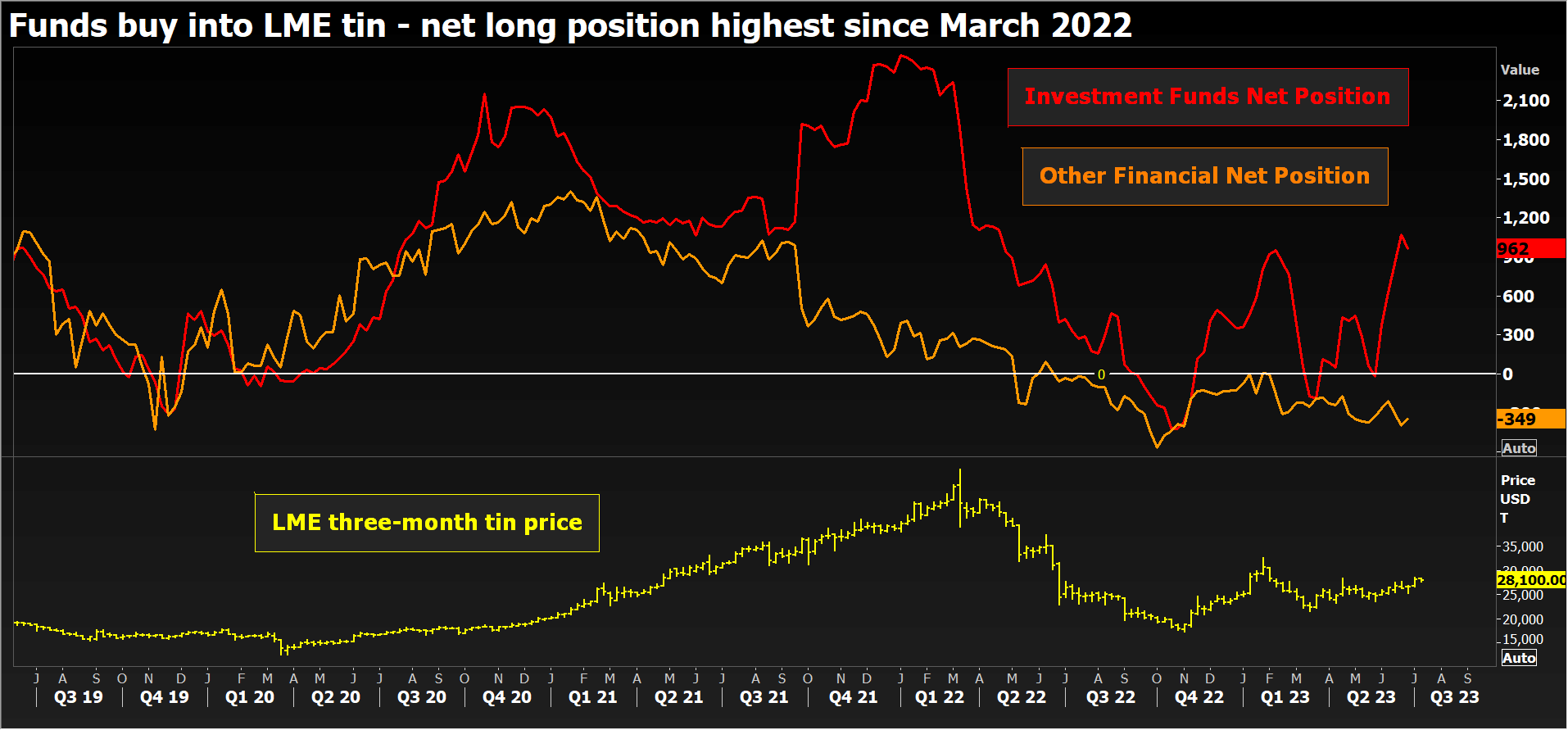

Fund managers turned bullish on tin in May and the net long position flexed out to 1,067 contracts in June, the largest collective bull bet since March last year.

The buying has helped three-month tin gain a foot-hold above the $28,000 per metric ton level, and is likely to have forced short position holders to cover, contributing to the cash tightness.

Last trading at $28,100, tin is holding at the very upper end of its six-month trading range even as time-spread tension eases.

Supply Disruption Looms

While tin supply has recovered from early-year disruption in Indonesia and Peru, a new threat is now looming.

From the start of next month, all tin mining will be suspended in the Wa region of Myanmar.

Controlled by the United Wa State Army (UWSA), the country's largest armed ethnic group, the region accounts for around 10% of global mined tin production.

It is a major supplier to China's tin smelters, representing around 26% of the country's demand last year, according to the International Tin Association.

The suspension of mining is to allow an audit of reserves after a decade of production.

No-one knows how long it will last.

Chinese producers such as Guangxi Huaxi Nonferrous Metal and Yinman Mining, a unit of Inner Mongolia Xingye Mining, have been shutting plants for maintenance and upgrade work.

Yunnan Tin Company, the world's leading tin producer, has just announced its Gejiu smelter will take a 45-day maintenance break from this week.

This looks like a concerted industry move to preserve stocks of raw materials until the situation in Myanmar becomes clearer.

If the mining suspension lasts a couple of months as expected, smelters should be able to navigate the interruption to flows of Myanmar concentrate.

However, if it lasts longer, both China and the rest of the world may need those exchange inventories of tin.

Source: