章节 2 Jul 7th: Europe Adds Aluminium to Its Critical Raw Materials List

[European Union (EU) countries have added aluminium to the list of minerals and metals covered by the Critical Raw Materials Act (CRMA). ]

European Union (EU) countries have added aluminium to the list of minerals and metals covered by the Critical Raw Materials Act (CRMA).

The Act is the centerpiece of the EU's strategy for ensuring it has the necessary inputs to compete with the United States and China in the global race to decarbonise.

The initial omission of aluminium from the CRMA was greeted with outrage from parts of the industry, the Federation of Aluminium Consumers in Europe lambasting EU policy-makers for "doing the opposite of what should be done".

The last-minute inclusion of the metal, together with its upstream feeds of bauxite and alumina, attests both to the criticality of aluminium to the green revolution and Europe's increasingly precarious security of supply.

Green Metal

Aluminium is already the second most widely used metal in modern society after steel thanks to its high strength-to-weight ratio.

Usage is expected to grow strongly over the coming years as the energy transition gathers pace.

The World Bank has identified aluminium as a "high-impact" and "cross-cutting" metal in all existing and potential green energy technologies from solar to geothermal.

Moreover, aluminium will play an important role in light-weighting electric vehicles, allowing automakers to get more mileage out of lithium-ion batteries.

Global demand is forecast by the International Aluminium Institute (IAI) to increase by almost 40% to 119.5 million metric tons by 2030, meaning the aluminium sector needs to produce an extra 33.3 million metric tons of metal over the decade.

Falling Output

As things stand, Europe is going to struggle to lift primary production at all over that time-frame.

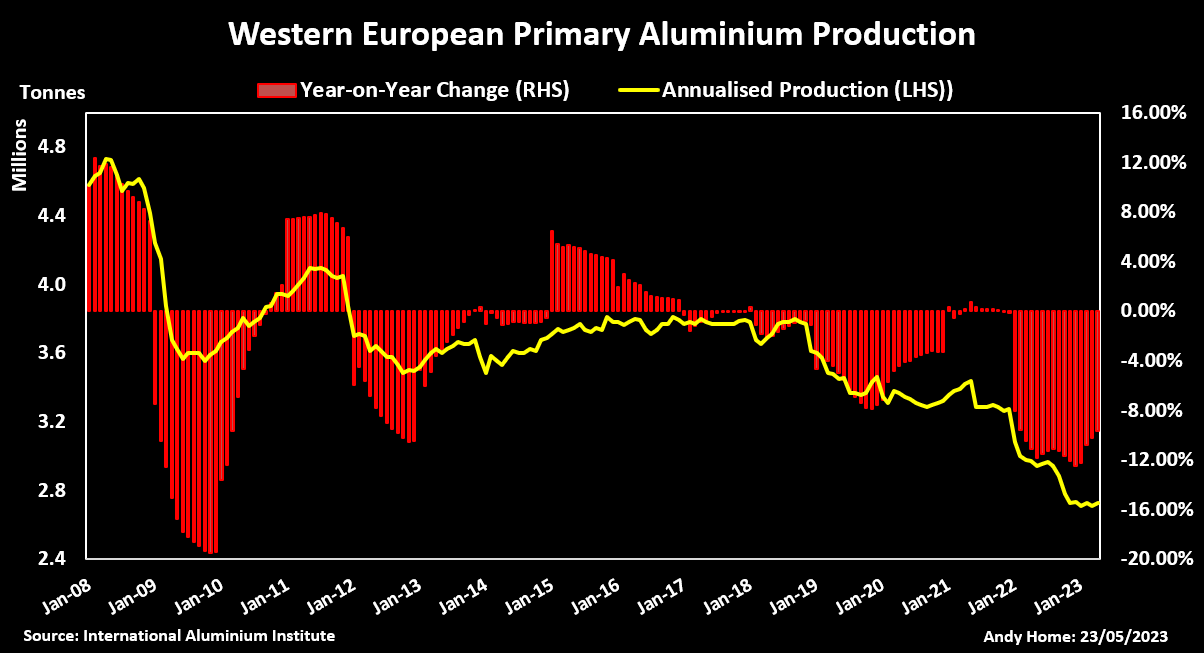

Western European production has been sliding steadily over the last 15 years with run-rates dropping from over 4.5 million metric tons to a current 2.7 million.

The sector has been squeezed between high European energy prices and years of high Chinese exports, largely in the form of semi-fabricated products.

Aluminium smelters consume a lot of power and the sector has taken another hit from the energy crunch that has followed Russia's invasion of Ukraine.

Europe lost another 850,000 tonnes of primary smelter capacity between October 2021 and March 2022, according to the EU.

Some, such as Alcoa's Spanish plant, will return after new, lower-carbon power supplies are secured. Some may well never return.

Import Dependency

European aluminium consumption averaged just over 5.0 million metric tons per year over the 2016-2020 period, according to the EU.

Import reliance averaged 56% over the same period, which is much lower than the bloc's 89% import reliance for bauxite and probably the reason why EU planners didn't originally include aluminium in the CRMA.

However, the key difference is where Europe sources its bauxite and primary aluminium.

Imports of bauxite over the 2016-2020 period came primarily from Guinea (70%), Brazil (14%) and Sierra Leone (10%).

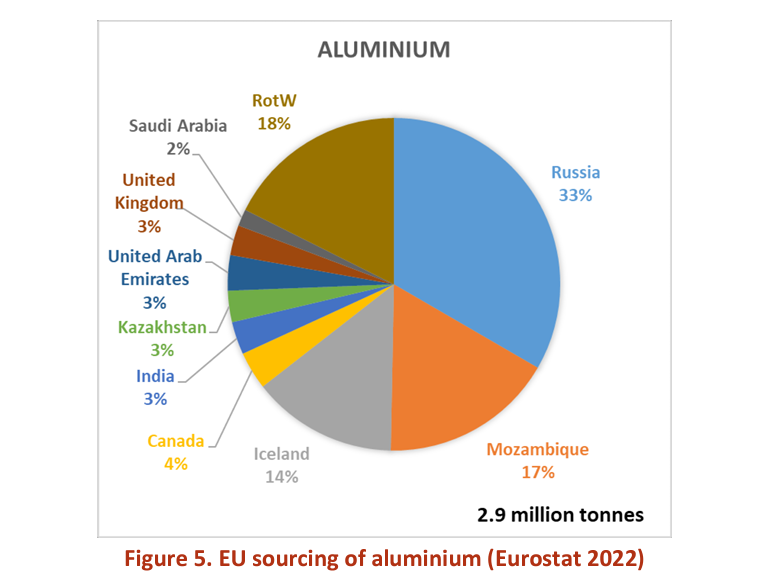

Imports of primary aluminium, by contrast, were dominated by Russian metal, which accounted for an average 33% over the same five-year period, according to the EU. The next largest supplier was Mozambique, which accounted for 17% of total imports, followed by Iceland, which accounted for another 14%.

Both the United States and Britain have imposed penal duties on imports of Russian metal but the importance of Russia to Europe's supply chain has meant there are no official European sanctions against Rusal, Russia's dominant producer.

However, the dependence on Russian supply is highly problematic given the increased tensions between the EU and its eastern neighbour after the invasion of Ukraine in February 2022.

If Russian supply were taken out of the import picture, Europe's aluminium dependence would become much more acute.

Power Problems

Getting aluminium onto Europe's critical raw materials list is an important win for the region's aluminium sector.

However, it's just the start.

Preserving what remains of the bloc's primary smelting capacity, let alone rebuilding it, is dependent on low-cost power, something that the EU is running short of right now.

The problem is compounded by aluminium producers' need to lower their carbon footprint. That requires lots of renewable power, something the region is even more short of.

The EU's proposed carbon border adjustment mechanism is another bone of contention. The European aluminium industry fears it will raise the cost of imports while not having any impact on global emissions in an industry dominated by China.

It's worth remembering that European processors are also paying import duties on both primary aluminium and alloy as a result of legacy attempts to protect the region's smelters.

Those import duties have evidently only slowed not halted the steady decline in European smelter production.

Targets

The EU's CRMA sets 2030 self-sufficiency targets of 10% of the bloc's consumption for production, 20% for recycling and 50% for processing. The last two have just been raised from 15% and 40% respectively.

In addition, no more than 65% of imports should come from any individual supplier.

If the EU is going to meet all those targets for aluminium, it's going to need a holistic approach that includes affordable green power pricing, a re-think of its legacy import duties and a possible fine-tuning of the proposed carbon border mechanism to reflect the reality of the global aluminium sector.

Putting it on the list of critical raw materials may be the easy part of that multi-dimensional challenge.

Source: