章节 7 Jun 12th: Funds Cover Short Positions in U.S. Soyoil, Corn and Hogs

[Speculators in the first days of June covered short positions across Chicago grains and oilseeds for a second consecutive week, motivated by dry weather for U.S. crops and multi-year lows across some contracts.]

Speculators in the first days of June covered short positions across Chicago grains and oilseeds for a second consecutive week, motivated by dry weather for U.S. crops and multi-year lows across some contracts.

Most-active CBOT wheat, soybean and soybean oil futures on May 31 hit multi-year lows, and soymeal fell to multi-month lows, but everything recovered in the following days.

Gains across most-active CBOT futures in the week ended June 6 were as follows: corn 2.4%, soybeans 4.4%, wheat 6.2%, soymeal 1% and soyoil 10.2%. December corn rose 3% and November beans added 2.7%.

Money managers in the week ended June 6 staged their largest round of short covering in CBOT soyoil since 2019, slashing their net short to 18,306 futures and options contracts from 37,449 a week earlier.

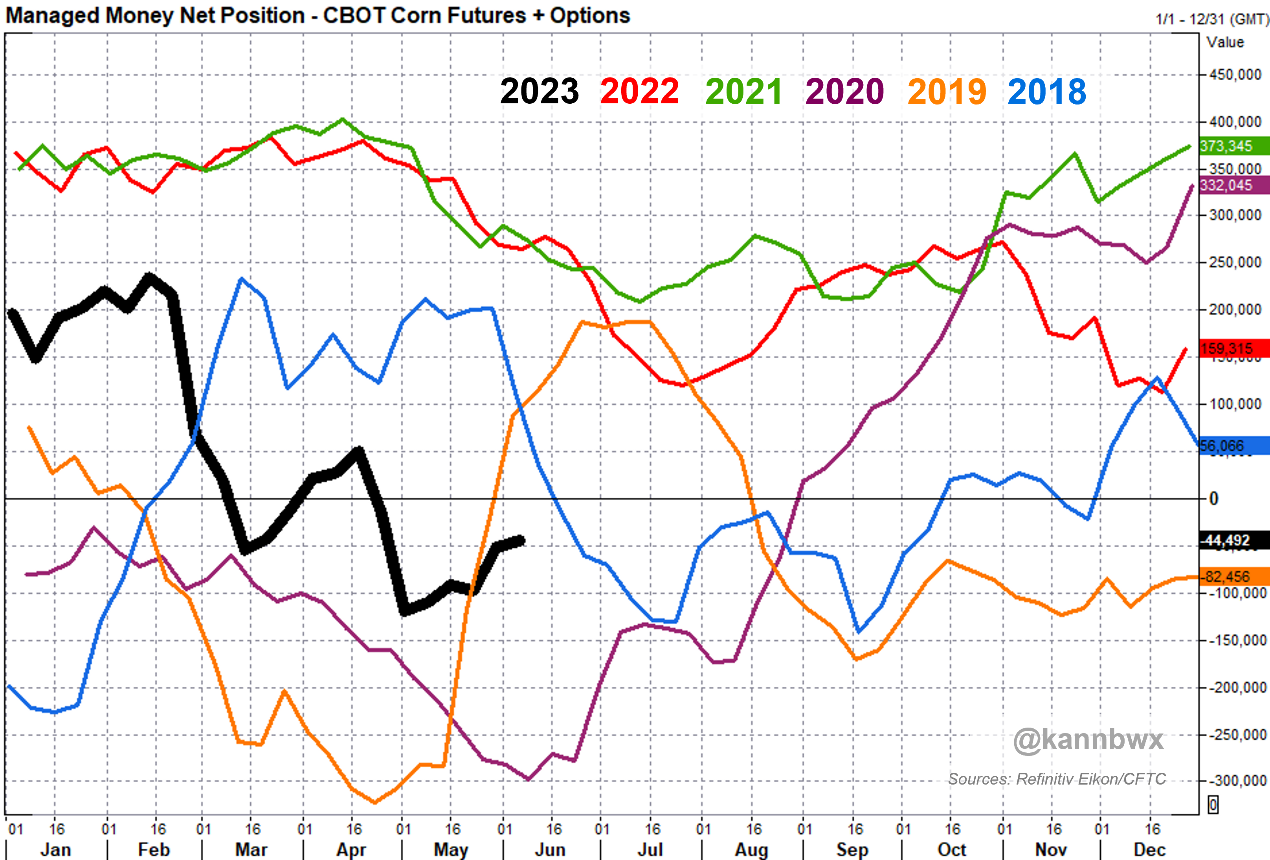

They also trimmed their net short in CBOT corn futures and options to 44,492 contracts from 51,065 in the prior week. That was mostly on short covering, though funds also reduced gross corn longs. Money managers have been net buyers of corn in nine of the last 12 weeks.

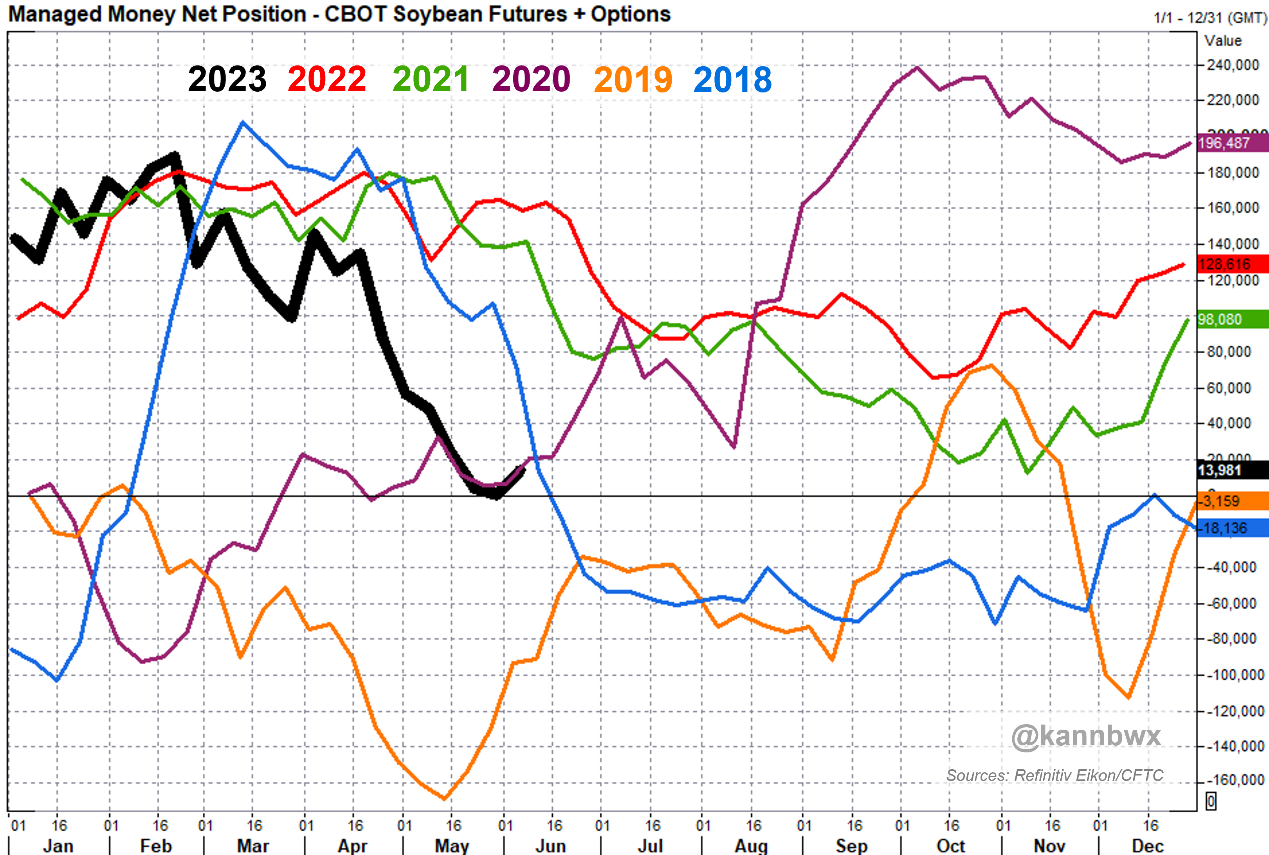

Commodity funds in mid-March established a net short in CBOT corn for the first time since August 2020, but they have not held a net short in soybeans since April 2020.

Through June 6, money managers increased their net long in CBOT soybean futures and options to 13,981 contracts from 529 a week earlier, and short covering was most prominent. However, they have been net sellers of soybeans and soyoil in nine of the last 12 weeks and sellers of meal in eight of the last 12.

Money managers have held a net long in CBOT soybean meal futures and options since November 2021, and they increased that position to 65,816 contracts through June 6 versus 59,676 in the prior week.

Funds continue carrying a heavy net short in CBOT wheat futures and options, though they trimmed it to 119,474 contracts in the week ended June 6 from 126,998 a week earlier. The last 12 weeks have been evenly split between net buying and selling in CBOT wheat.

Open interest in CBOT wheat futures and options remains below average, though last week it hit the highest levels since March 2022, up 6% from early June 2022.

The week ended June 6 featured money managers' largest round of short covering in CME lean hogs since March 2019. Funds slashed their net short to 16,173 futures and options contracts from a record 31,110 a week earlier. CME July hogs rose 11% that week after hitting contract lows in late May.

Money managers' net long in CME live cattle rose to 114,637 futures and options contracts through June 6, their most bullish since April 2019 and up about 6,800 on the week. Most-active August futures rose about 5% in that period, though the front-month contract on Wednesday hit an all-time high.

Futures price action was mixed over the last three sessions. Most-active soybean oil featured the biggest gains at 7.2%, and corn was the biggest loser with December down 1.9% and most-active corn down 0.6%, mostly on weekend rain expectations for the U.S. Corn Belt.

CBOT wheat and soybean meal rose fractionally over the last three sessions, but most-active soybeans added 2.5% and November beans were up 1.6%. On Friday, most-active soybeans reached their highest levels since May 16, and CME July hogs were the highest since May 3.

Rains were scattered across the U.S. Midwest this weekend, and areas that received lighter amounts will be aided by cooler temperatures early this week. However, heat may return to the Corn Belt late next week, upping the need for ample, widespread rains, which are not guaranteed in the forecasts.

Source: Market Screener