فصل 1 Basics of Forex Trading

What is forex?

The foreign exchange market, which is usually known as “forex” or “FX,” is the largest financial market in the world.

Quite simply, it’s the global financial market that allows one to trade currencies.

If you think one currency will be stronger than the other, and you end up correct, then you can make a profit.

An exchange rate is the relative price of two currencies from two different countries.

You’ve exchanged one currency for another.

The forex market is open 24 hours a day and 5 days a week, only closing down during the weekend.

The day starts when traders wake up in Auckland/Wellington, then moves to Sydney, Singapore, Hong Kong, Tokyo, Frankfurt, London, and finally, New York, before trading starts all over again in New Zealand!

Instead, most of the currency transactions that occur in the global foreign exchange market are bought (and sold) for speculative reasons.

Currency traders (also known as currency speculators) buy currencies hoping that they will be able to sell them at a higher price in the future.

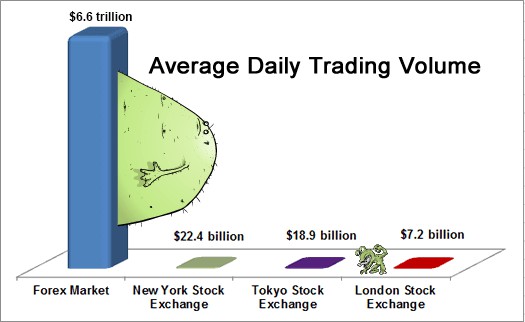

Compared to the “measly” $200 billion per day volume of the New York Stock Exchange (NYSE), the foreign exchange market looks absolutely ginormous with its $6.6 TRILLION a day trade volume.

The largest stock market in the world, the New York Stock Exchange (NYSE), trades a volume of about $200 billion each day. If we used a monster to represent the NYSE, it would look like this…

But if you actually compare it to the forex market, it would look like this…

Check out the graph of the average daily trading volume for the forex market, New York Stock Exchange, Tokyo Stock Exchange, and London Stock Exchange:

Forex Trading Sessions

Now that you know what forex is, why you should trade it, and who makes up the forex market, it’s about time you learned when you can trade.

It’s time to learn about the different forex trading sessions.

Yes, it is true that the forex market is open 24 hours a day, but that doesn’t mean it’s always active the entire day.

The uptight ones who probably got straight A’s and followed all the rules as children only consider USD, EUR, JPY, GBP, and CHF as major currencies.

Then they label AUD, NZD, and CAD as "commodity currencies ".

Forex Market Size And Liquidity

Unlike other financial markets like the New York Stock Exchange (NYSE) or London Stock Exchange (LSE), the forex market has neither a physical location nor a central exchange.

The forex market is considered an over-the-counter (OTC) market due to the fact that the entire market is run electronically, within a network of banks and non-bank financial institutions (NBFIs), continuously over a 24-hour period.

This means that the FX market is spread all over the globe with no central location.

Trades can take place anywhere as long as you have an internet connection!

The U.S. dollar is the most traded currency, making up 84.9% of all transactions!

The euro’s share is second at 39.1%, while that of the yen is third at 19.0%.

What is a Pip?

If EUR/USD moves from 1.1050 to 1.1051, that .0001 USD rise in value is ONE PIP

For example, for EUR/USD, it is 0.0001, and for USD/JPY, it is 0.01.

0.0001= 1 pip

EUR/USD = 1.1051

pip

What is a Lot in Forex?

A “lot” is a unit measuring a transaction amount.

1. USD/JPY at an exchange rate of 119.80: (.01 / 119.80) x 100,000 = $8.34 per

2. USD/CHF at an exchange rate of 1.4555: (.0001 / 1.4555) x 100,000 = $6.87 per

In cases where the U.S. dollar is not quoted first, the formula is slightly different.

1. EUR/USD at an exchange rate of 1.1930: (.0001 / 1.1930) X 100,000 =

8.38 x 1.1930 = $9.99734 rounded up will be $10 per pip

2. GBP/USD at an exchange rate of 1.8040: (.0001 / 1.8040) x 100,000

= 5.54 x 1.8040 = 9.99416 rounded up will be $10 per pip.

What is leverage?

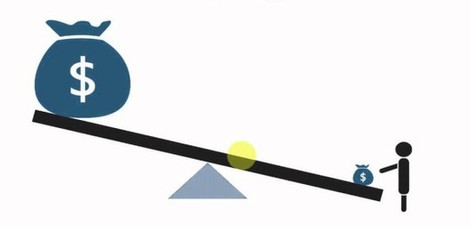

You are probably wondering how a small investor like yourself can trade such large amounts of money.

Think of your broker as a bank that basically fronts you $100,000 to buy currencies.

All the bank asks from you is that you give it $1,000 as a good-faith deposit, which it will hold for you but not necessarily keep.

Sounds too good to be true? This is how forex trading using leverage works.

For example, if the allowed leverage is 100:1 (or 1% of the position required), and you want to trade a position worth $100,000, but you only have $5,000 in your account.

For example, if the allowed leverage is 100:1 (or 1% of position required), and you wanted to trade a position worth $100,000, but you only have $5,000 in your account.

What is a Spread in Forex Trading?

Forex brokers will quote you two different prices for a currency pair: the bid and ask price.

The “bid” is the price at which you can SELL the base currency. The “ask” is the price at which you can BUY the base currency. The difference between these two prices is known as the spread. Also known as the “ bid/ask spread“

Order Types

There are some basic order types that all brokers provide and some others that sound weird.

Orders fall into two buckets:

1. Market order: an order instantly executed against a price that your broker has provided.

2. Pending order: an order to be executed at a later time at the price you specify.

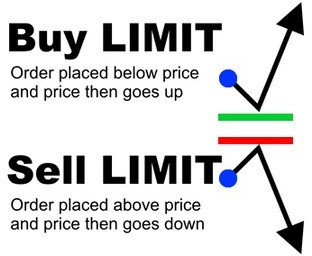

Here’s a quick “map” of the different types of orders within each bucket. Buy Limit – if you plan on going long at a level lower than the market price Sell Limit – if you plan on going short at a level higher than the market price Buy Stop – if you plan on going long at a level higher than the market price Sell Stop – if you plan on going short at a level lower than the market price

Introduction to MetaTrader 4

Congratulations! If you’ve made your way to this lesson, it means that you’re now ready to open a demo or live MetaTrader 4 (MT4) trading account.

And because BabyPips.com is the bee’s knees, we’re here to guide you through it.

First, you should know that MetaTrader 4 (MT4) is simply a trading platform used by tons of traders and brokers.

Traders use it to view real-time currency prices, open or adjust orders, get technical and fundamental analysis. Meanwhile, brokers use the MT4 platform to reach a broader audience.

What’s good about the MT4 platform is that it offers boatloads of currency pairs and indicators that you can choose from.

Not only that, but its customizable charts are so newbie-friendly that any six-year-old kid can spot breakout patterns from it.

Mechanical traders can also plug in their EAs in the MT4 platform. This makes it easy for them to track trade opportunities.

The MT4 platform can’t be accessed through a website though. You have to install the platform on your computer or your phone before you can gain access to your trades and currency prices.

MT4 Basics: How to Set Orders

Now that you’ve set up your MT4 account, it’s time to learn how to use it!

We know, we know. With so many tabs, windows, and buttons, the MT4 platform can look a little bit intimidating if it’s your first time using it.

But don’t worry, it won’t bite! Besides, we’ll be holding your hand through the entire process and go nice and slow.

We’ll start with the basics – setting orders.

By the time you’re done with this lesson, you’ll know how to:

1. Buy or sell via market execution

2. Buy or sell via pending order

3. Modify a trade after it has been entered

What Is Risk Management?

Risk management is one of the most important topics you will ever read about trading.

Why is it important? Well, we are in the business of making money, and in order to make money, we have to learn how to manage risk (potential losses).

Ironically, this is one of the most overlooked areas in trading.

Many forex traders are just anxious to get right into trading with no regard for their total account size.

They simply determine how much they can stomach losing in a single trade and hit the “trade” button.

There’s a term for this type of investing….it’s called…

GAMBLING! Never Risk More Than 2% Per Trade

How much should you risk per trade?

Great question.

Try to limit your risk to 2% per trade.