فصل 25 Market Analysis Articles May 4th

Market Analysis 4th May 2023

Market Breaking News

Stocks fell on Wednesday after the Federal Reserve raised interest rates as expected. The Dow Jones Industrial Average, S&P 500, and Nasdaq Composite all closed lower and notched three-day losing streaks.

Fed Chair Jerome Powell ruled out cutting interest rates, causing concern among traders about the impact on economic activity and hiring. However, the Fed appeared to soften its language on future rate increases by dropping a line from the March statement.

These Fed statement resulting in weak USD which create a higher movement in most of the major currencies and gold.

We are expecting that this rate increase will likely be the last one in this cycle, with the central bank keeping rates on hold until at least the end of the year.

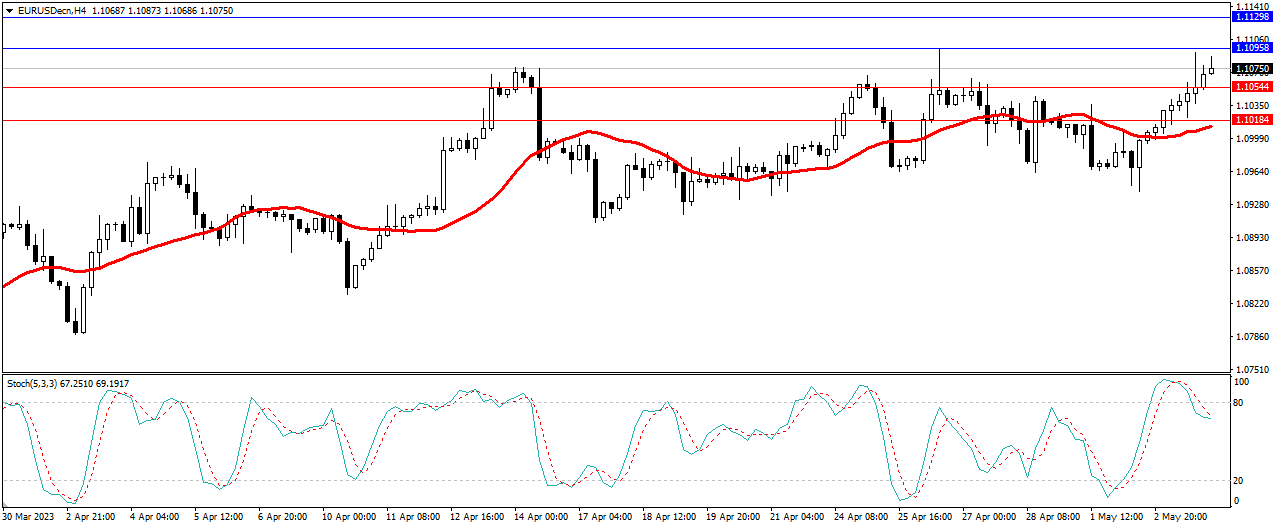

EURUSD

EURUSD continue to move higher and break our previous resistance levels. EURUSD currently running at 1.1075.

At the time of writing, the four-hour Stochastic indicator is moving lower after exited the oversold area, the price is moving ABOVE the 20-period moving average. Today we will have ECB Rate statement which will move the EUR/USD in high volatility. We are expected will continue to move higher EURUSD and reach our resistance levels at 1.1129.

Resistance: 1.1095, 1.1129

Support: 1.1054, 1.1018

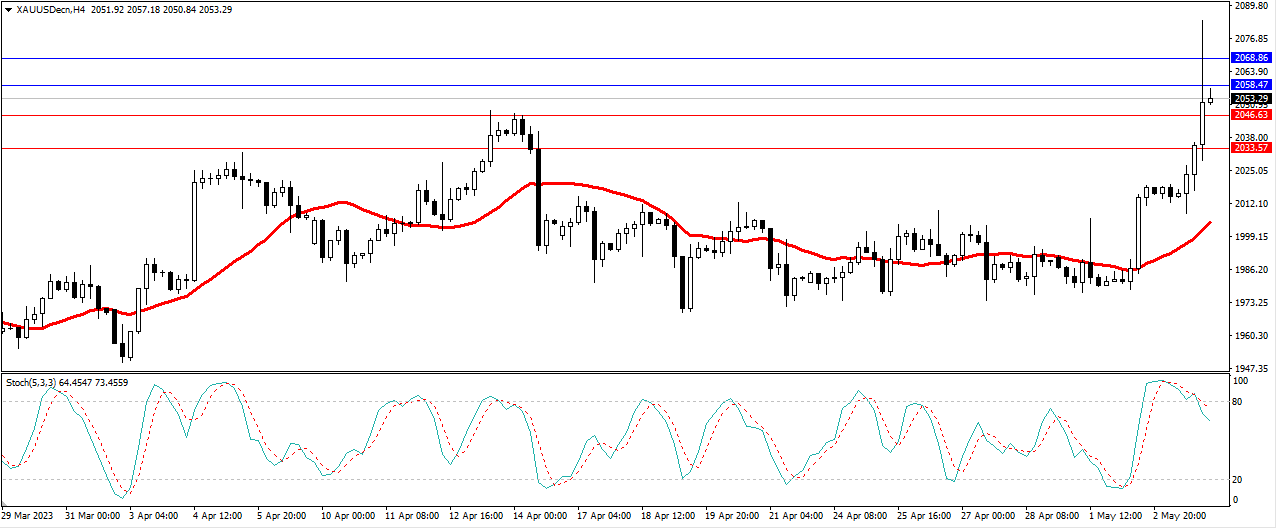

GOLD

Gold rise as high as $2,084 on Wednesday and break our previous resistance levels. Gold currently is running at $2,053.

At the time of writing, the four-hour Stochastic indicator is moving lower exiting the oversold area. The price is moving ABOVE the 20-period moving average. We expect that Gold will be consolidating with the potential of continue to move higher and reach back to the resistance level at $2,068.

Resistance: $2,068, $2,058

Support: $2,046, $2,033

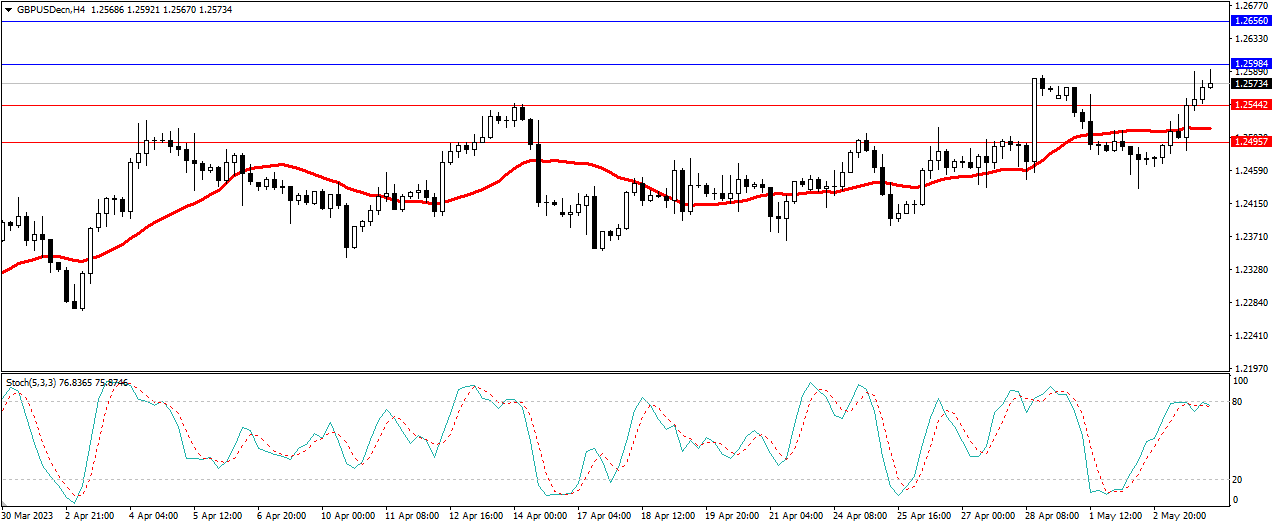

GBPUSD

GBPUSD were moving higher on Wednesday and break our previous resistance levels. Currently, GBPUSD is trading at 1.2573.

As of this writing, the four-hour Stochastic indicator is moving near the overbought level. The price is moving ABOVE the 20-period moving average. We expect GBPUSD to move higher for today and try to reach our resistance level at 1.2598.

Resistance: 1.2598, 1.2656

Support: 1.2544, 1.2495

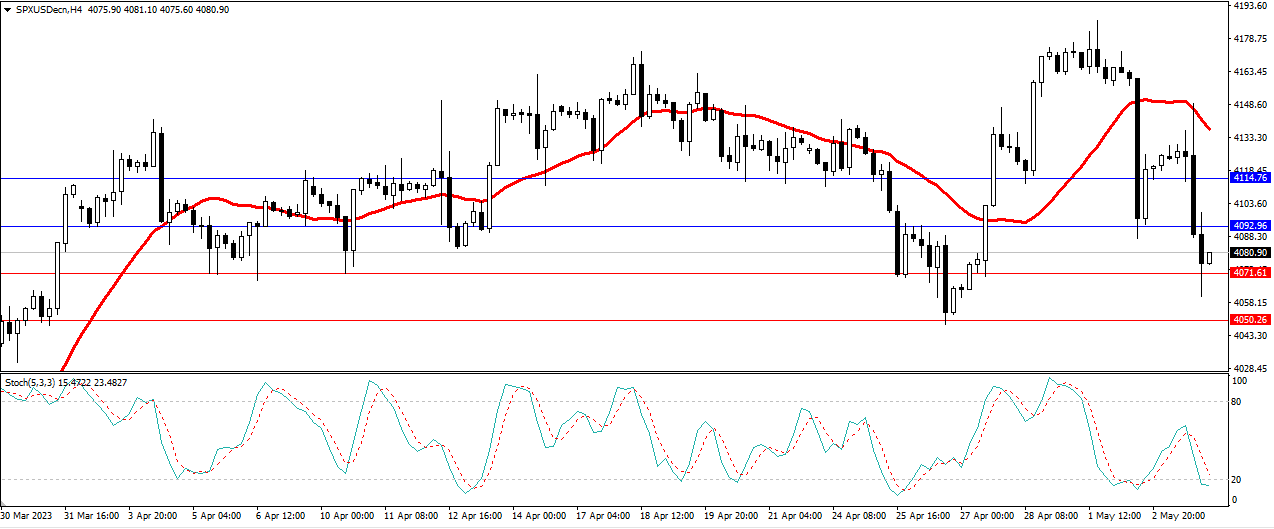

SPXUSD

SPXUSD moved lower and break our previous support levels. SPXUSD currently is running at 4080.

As of this writing, the four-hour Stochastic indicator is moving lower toward the oversold level, and the price is moving BELOW the 20-period moving average. We expect that SPXUSD might continue to move lower and reach back to our support level at 4070.

Resistance: 4092, 4114

Support: 4070, 4050

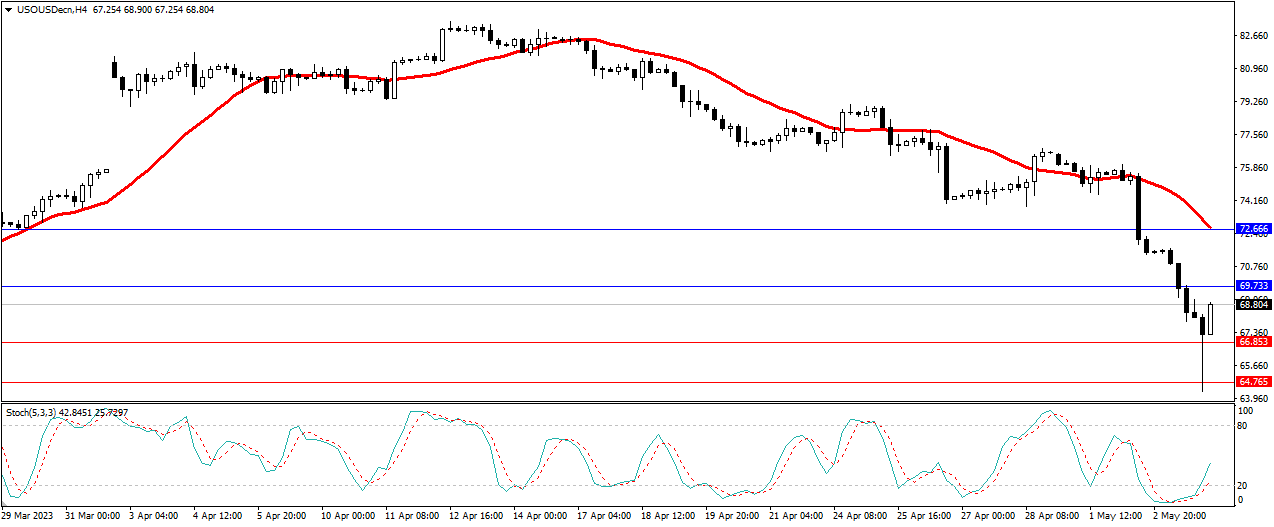

USOUSD

USOUSD (WTI) moves lower on Wednesday and able to reach as low as 64.29. Currently USOUSD is trading at 66.80.

As of the time of writing, the four-hour Stochastic indicator is moving just above the oversold area and moving higher, the price is moving BELOW the 20-period moving average. We expect that USOUSD to move higher and reach our resistance level at 69.73.

Resistance: 69.73, 72.66

Support: 66.85, 64.76

Key event for the day:

EUR Main Refinancing Rate

EUR Monetary Policy Statement

USD Unemployment Claims

EUR ECB Press Conference

CAD BOC Gov Macklem Speaks