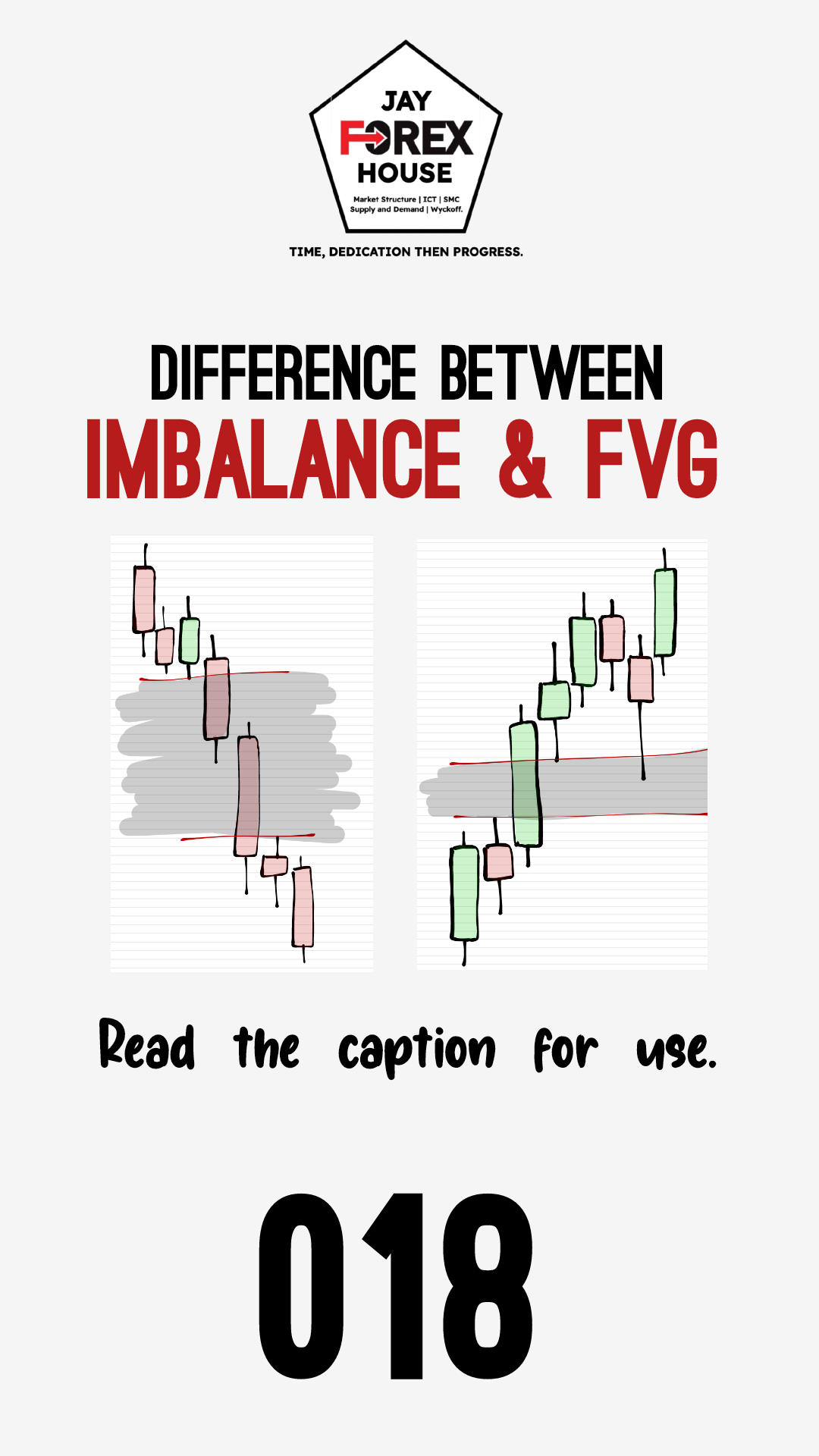

📚SAVE THIS: An average IMBALANCE is supply and demand, while FVG (Fair Value Gap) is a technical theory or method from the inner circle trader (ICT).

Video in our channel.

• What is FVG and ICT method:

The Inner Circle Trader (ICT) is associated with a trading methodology developed by a trader named Michael J. Huddleston. This approach often involves analyzing imbalances in supply and demand to make trading decisions using time series understanding of different sessions of the market with the understanding of price action. Or you can just say ICT method. 😅 So yes all those channels claiming to be ICT trading or theories are not of Michael J. Huddleston. Just traders who claim to have studied and understand his methods and might know him. So he developed the Fair Value Gap (FVG) theory, and the concept is not just imbalance.

• What is IMBALANCE: Imbalance in supply and demand, in this context, refers to discrepancies between buying and selling interest in the market. It's the gaps in those big spick candles that were created by massive news or volatility. The FVG method refers to how traders can capitalise on these gaps created for a good position of a re-entry of the trend.

Follow @jayforexhouse to learn trading for free. Name a patterns you would like us to break down for you in the comment section...

.#forex #bitcoin #forextrader #trading#forextrading #money#forexsignals#cryptocurrency #trader #investment#crypto #investing #business#entrepreneur #blockchain #forexmarket #forexlife #stocks #success #btc #stockmarket #binary #fx #finance